Jumio, the leading provider of AI-powered end-to-end identity orchestration, eKYC and AML solutions, today announced that the company is acquiring current strategic partner 4Stop, the leading data marketplace and orchestration hub for KYB, KYC, compliance and fraud prevention. The addition of 4Stop’s data sources to the Jumio KYX Platform realizes Jumio’s strategic vision of redefining the end-to-end identity industry....

Read Press Release

WEBINAR: Know Your Risk. Always.

How to Trust Your Fraud Prevention Data to Maximise Conversions? A guide to increasing risk data confidence to secure engagements quicker, improve retention and profitability, while obtaining future-proofed risk mitigation.

Watch Now

News & Articles Published by 4Stop

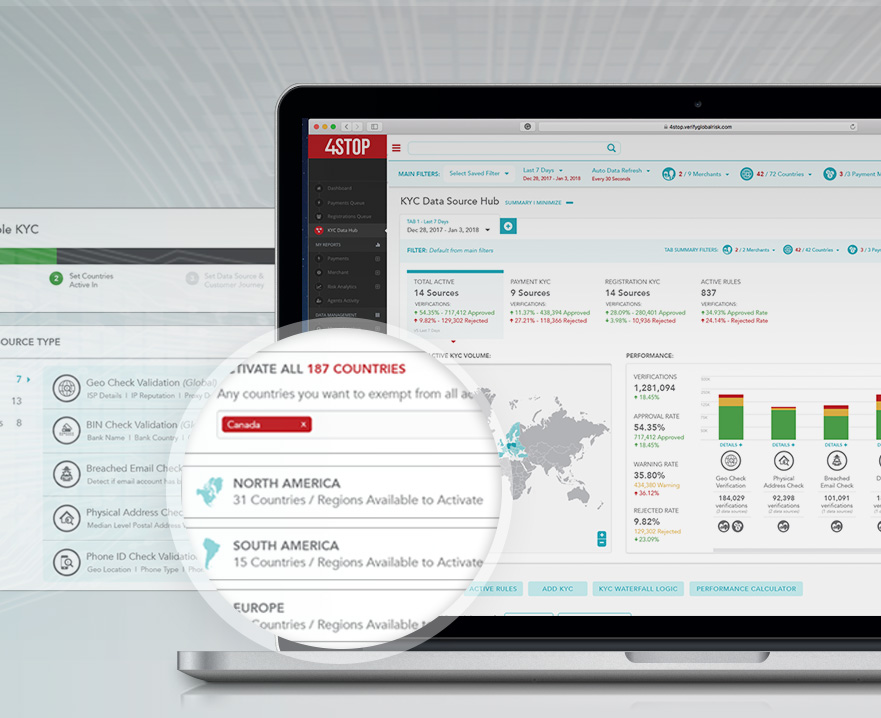

The Paypers Fraud Prevention in Ecommerce Report 2021/2022 has launched. Within the report are award-winning global data marketplace and orchestration hub includes 55+ partner integrations, enabling access to over 650 data sources, 1000's of data sets and an exponential number data points, across 195 countries. Our digital world demands data and risk mitigation. There has been substantial engagement growth seen online and covid-19 has further...

Read Report & ProfileAs a regulated company, ZBX needs to operate in a fully compliant manner while also obtaining premium fraud defence in the digital industry. 4Stop's end-to-end and customisable data and risk marketplace quickly enable ZBX with peace-of-mind and confidence in its compliance management. 4Stop provides them with secure customer onboarding and engagement globally and doing so in a manner that does not bring forth high costs, multiple third...

Read Press ReleaseThrough leading global KYC data services in combination with advanced monitoring technology, behaviour tracking, risk data analysis scoring and more instantly obtain your iGaming social responsibility solution from one API. The iGaming industry revenue soared to USD 66.67 billion in 2020, as consumers turned towards the online platform to bridge their financial, social, and psychological crises during lockdowns. The industry is going through a revival and is...

Read ArticleLeverage Data Orchestration Hubs to build personalised player engagement and improve overall life-time value. Since its widespread growth in the 1990s and early 2000s, the Internet has changed nearly every aspect of our lives by connecting us with people worldwide and pushing us to develop new, innovative technologies. With massive technological developments taking place, gaming websites are more accessible across the globe - the market has...

Read ArticleThe Paypers has interviewed us to learn about the importance of orchestration hubs with smart customer verification for an optimum global risk mitigation strategy. The pandemic has utterly shaken the core of our global economic landscape; however, it has driven technological advancements many years ahead of its time. Throughout the pandemic globally, we have seen a 22.3% increase in internet users with a 40.3% increase in online traffic...

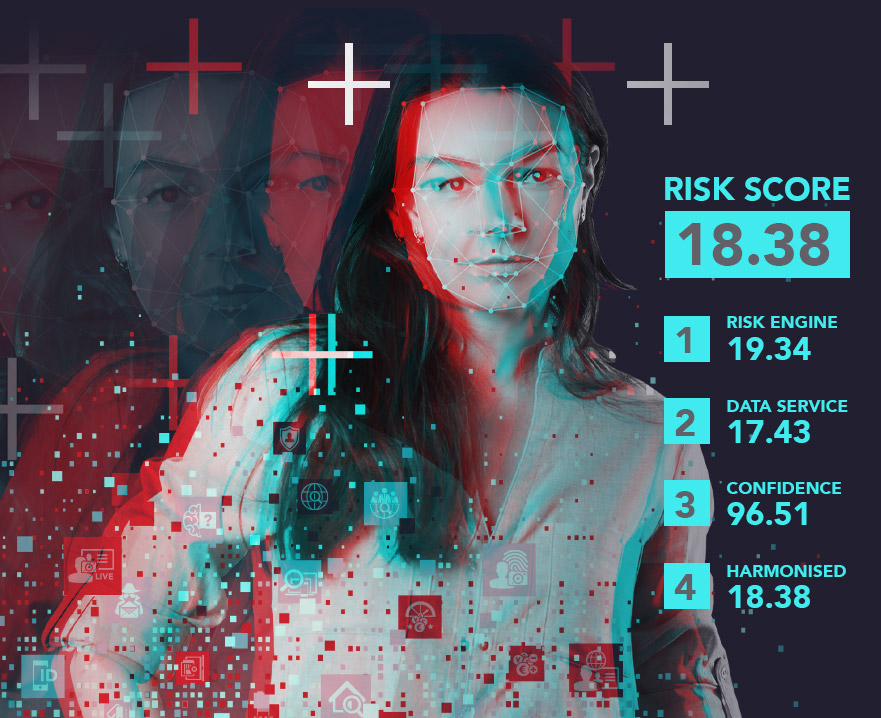

Read ArticleUnveiling our risk scoring technology that unifies four layers of analysis obtained from KYC data verifications, harmonised into one highly accurate risk score for trust and confidence. When performing KYC, many factors are retrieved and extracted from the data performance. 4Stop has leveraged all aspects of these components to develop its strategy in providing the world’s leading risk marketplace...

Read ArticleAny business's greatest fear is waking up to losses incurred on years of hard work and sweat. An ideal economic world for a company would be one with minimum or no losses and, of course, an advantage all the time over their competition. However, in reality, everyday companies suffer significant losses with online fraud as a key contributor. And, as technological advancements continue to evolve...

Read ArticleOur unique contribution on our global data and risk marketplace to the Fintech industry has been recognized as the best Global KYC & Risk Management Platfom.The digital world demands data and risk mitigation. Substantial engagement growth seen online has further grown these volumes – setting new expectations. Industries globally struggle to manage data, KYC, risk and compliance...

Read Win AnnouncementOver the last few months, there has been increased adoption of cryptocurrencies. They are finally surfacing as a palatable alternative payment method to fiat, with more than 5000 different tokens now being traded in various parts of the globe. One survey unveiled that 45 per cent of respondents preferred Bitcoin rather than stocks, real estate, and gold, and trust in Bitcoin has grown 29% in the past three years...

View Our ProfileThe global pandemic forged a new evolution of online engagement that many experts were not anticipating for years. Online businesses desperately require customer onboarding and fraud prevention solutions in a future-proofed, agile, and streamlined manner. The Paypers fraud report provides essential insights and profiles on many industry-leading solution providers.

View Our ProfileiGaming and gambling platforms have always been continually managing outside forces from technology demands, customer engagement preferences, regulatory evolutions, and economic changes. We discuss the current challenges faced within the industry and how KYC orchestration hubs with dynamic fraud prevention are mitigating these challenges in a frictionless manner...

Read Press ReleaseAnnounces tremendous company growth experienced quarter-over-quarter in 2020. As a result, 4Stop has experienced a doubling year-over-year top-line performance with 100% revenue growth."Our relentless focus on data and product innovation to future-proof risk mitigation from one integration proved itself this past year." In 2020, 4Stop performed data and risk calls increased by 134% from the...

Read Press ReleaseThe process of onboarding a new entity or entering into a new business relationship traditionally involves substantial manual techniques, including intensive paperwork from filling forms, checking boxes, or performing thorough background checks. Entering a business relationship requires the same prudence many businesses implement for their B2C KYC risk mitigation. The regulatory environment...

Read ArticleThe global pandemic has utterly shaken the way people live and interact and as a result, our online eco-system has experienced a boom this year like no other - posing as a significant opportunity for eCommerce merchants, PSPs and any entity engaging online. Featured in "The Paypers Fraud Prevention Report Guide 2020", discover how our orchestration hub with hundreds of data sources can...

View ProfileUnderwriting merchants is a vital part of businesses sustainability. It's the first level of defence against fraud and illicit activity towards an entity. This partnership between 4Stop and 123signed truly compliments each other's objectives at combatting cumbersome business onboarding challenges through a modern, fail-safe and future-proofed platform...

Read Press Release"Switching to ComplyAdvantage has allowed us to easily expand our watchlists and adverse media sources while making our results more efficient; reducing false positives and receiving continuous, simple and cost-effective monitoring of entities. It's a real game changer."...

Read Use Caseemerchantpay empowers businesses around the world to accept seamless payments with sophisticated payment technology. We are pleased to announce and discuss how they are advancing their fraud prevention processes worldwide with our leading KYC and anti-fraud solutions - maximising their onboarding and risk mitigation agility...

Read Press ReleaseThe fintech market has evolved at a rapid pace and continues transforming and innovating the financial services sector in areas such as payments, lending, personal finance and banking to name but a few. Providing safer and more reliable solutions to a myriad of economic institutions. We are excited that our newly developed KYB solution is leading...

Read Award AnnouncementPaytah by Monetum brings innovation to the Fintech market to enable cross-border transactions, and IBAN accounts conveniently and reliably from anywhere in the world. Through their integration they've enabled leading fraud defence and transactional monitoring - bringing heightened confidence risk is mitigated...

Read Press ReleaseIt is imperative for businesses globally to rethink strategy, sync with leading technology developments and adapt their business mantras for future-proofed agility and sustainability regardless of economic change. Watch our webinar where we take a look at our current online ecosystem trends and predictions and how a data orchestration hub complete...

Watch WebinarA recent survey unveiled that 45 per cent of respondents preferred Bitcoin rather than stocks, real estate, and gold. As a result we are seeing a rapid rise of adoption. Crypto businesses need to harness the power of orchestration hubs to obtain all the KYC data services required with utmost agility and automation in fraud defence to maximise user...

Read ArticleThe COVID-19 pandemic has accelerated the importance of digital channels, and by extension, digital identification and verification methods. While the underlying trend was already there, the pandemic has meant that companies have had to quickly adapt to a surge in online traffic and a change in consumers’ habits. According to Statista (1), online traffic...

Read ArticleGlobal restrictions, social distancing rules, and every other change Covid-19 has made to our lives have forced businesses to adapt to new challenges, however. Chief among these are the new opportunities for fraudsters that increased online activity and transactions bring, with communications from governments and organisations...

Read Press ReleaseWe are thrilled to be selected as one of the top 100 globally recognised most innovative providers of digital solutions of 2020, providing world-class cyber defences to financial institutions. Our innovative orchestration hub is solving global KYB, KYC and anti-fraud from a single end-point and empowering businesses with data...

Read Press ReleaseOnline entities have always been continually managing outside forces from savvy competitors, technology demands, customer engagement preferences, regulatory evolutions, and economic changes. Our world can quickly change and businesses need to be able to adapt their risk mitigation processes with ease to ensure success regardless of our...

Read ArticleAs people continue to accumulate to life locked-down with their primary access to the outside world through digital connection we look at the worldwide impact witnessed in the gaming industry and discuss strategies to efficiently manage the volume increases, global fraud defence and regulatory changes many countries are mandating because of these...

Read ArticleCustomer trust, loyalty and retention is most important now than ever. As experts in risk mitigation, 4Stop and TransUnion will share an array of strategies to solve PSD2 implementation with minimal impact to your business and in the most frictionless manner for your customers experience. Discuss how to manage the impact of PSD2, prioritize...

Download eBookCybersecurity is more important than ever as we globally are experiencing one of the worst pandemics of this century with COVID-19 impacting more than 150 countries and rapidly rising online engagements. However with this surge of internet users some countries have witnessed an increase of 400% in online fraud. We take a look at how it is impacting...

Read ArticleAs more people shop online, fraudsters have been taking note and mimicking common consumer behavior. For instance, in 2019, TransUnion consortium data found a 118% increase in risky transactions from mobile devices. There have also been ongoing shifts in fraud as card-not-present (CNP) fraud continues to increase...

Read ArticleThrough this partnership, 4Stop has enriched its data orchestration hub with ComplyAdvantage's world-class dynamic and interlinked datasets for screening and monitoring technology on AML data, adverse information and published media. Our online economy is rapidly expanding where businesses need to instil the best...

Read Press ReleaseThe Paypers have launched their new "Digital Onboarding and KYC Report 2020". Detailing key insightful perspectives on global KYC management, latest identity verification and authentication technology and trends. In the recent Global Digital 2019 Report reveals that internet users are growing by an average of more than one million new users every day...

View Our ProfileAs payments and online engagement continue to expand, as do our global fraudsters. How businesses are implementing an array of KYC, not just for compliance, but expanding their KYC data services to truly identify digital identities for all touchpoints of the customer journey and in a manner that has little to no impact on their development resources...

Read ArticleWe're excited to announce our partnership with BCCS (Blockchain Cybersecurity and Compliance Solutions) Cluster to enhance their value chain of services with leading KYB, KYC, AML and anti-fraud technology. This partnership brings continued synergy to the mantra of providing one-stop solutions to empower businesses online with leading...

Read Press ReleaseWe're excited to announce our partnership with Hexopay, which brings together shared ethos of single API platforms. Both companies have taken this approach to enable merchants to integrate once and access everything they need for true global coverage, optimisation of customer onboarding and authorisation, whilst mitigating fraud risk...

Read Press ReleaseToday’s global regulatory environment is in constant flux. As digitalization continues to spread through more and more industries, regulations—especially in areas like data privacy and Know-Your-Customer (KYC) policies—will have to evolve to keep up. Yet, regulations always play a catch-up game, constantly half a step behind industry innovations...

Read ArticleIn this webinar 4Stop and iovation; leaders driving innovation for secure online engagements, discuss how businesses can harness the new PSD2 regulation to maximise customer experience, trust, loyalty and increase overall customer life-time value. To utilise the power of PSD2 as a competitive advantage and accelerate their business.

Watch WebinarAnnounces the launch of their enriched payment monitoring and intelligence experience. Designed through the teams consolidated 60-years risk management expertise 4Stop's new payment hub encompasses modular architecture with innovative features for optimal payment data ingestion. 4Stop is bringing clear insights and intelligence on...

Read Launch AnnouncementFor any business, it’s important to know your customer (KYC). In today’s interconnected world of increasingly global corporations mean that companies must take a myriad of different regulations into account when planning their processes. This is a complex challenge, and the penalties for not meeting them are severe...

Read ArticleWe discuss the importance of leveraging modern technologies such as data automation paired with real-time analytics and dynamic decision-making frameworks to solve the cumbersome manual due-diligence process. Resulting in seamless merchant onboarding and optimal fraud prevention at the first level of engagement...

Read ArticleWe are so proud of our team, our platform and world-class technology to have achieved this award of being selected in the RegTech100 for 2020. You can view our profiles within the RegTech100 companies for 2020 available to be downloaded in a research pdf from their website. The RegTech (regulatory technology) industry has established...

View Our ProfileWe're excited to announce today our integrated partnership with Jumio. Through this partnership, Jumio’s market-leading AI-powered identity verification service, with certified liveliness detection, has been integrated into our data hub and now readily available for activation in one-click. Jumio’s identity verification solutions enable businesses to...

Read Press ReleaseWatch The Journey to the Future of Money exclusive interview with our CSO Ian Green and our VP Merchant Underwriting Christian Wheeler as they discuss KYB, KYC, fraud prevention. Along with innovative technology solutions and trends seeing worldwide within digital identities and the payment landscape.

Watch VideoWe've been profiled within The Paypers Fraud Prevention and Online Authentication Market Guide 2019/2020. This years report showcases key insightful perspectives on fraud management, identity verification, online authentication and regulation. In today’s ever-changing online eco-system that...

Download ReportIn this eBook developed in partnership with iovation; leaders passionate about making online engagements user-friendly, secure and trustworthy, discuss the benefits device intelligence, multi-layered KYC and automated anti-fraud tools offers your customer engagement and fraud defence.

Download eBookWe've expanded our global KYB solution. Designed to allow you to maximise your B2B onboarding in a fully automated, data-driven, compliant and risk-free manner. Dramatically reducing the complexity, resources, time, costs and manual processes currently experienced within underwriting.

Read Press ReleaseWe’re excited to welcome Christian Wheeler as our VP Merchant Underwriting. As a specialist within KYB his insights and expertise will bring great value to our technology enhancements and help us deliver a relevant, innovative and data-driven product for global underwriting.

Read Press ReleaseExemplifying Steadiness, Stability, and the Ability to Motivate Innovation. CEO’s that emerge and manage businesses that engage in our ever-changing, fast-paced global online ecosystem require significant virtues composed of steadiness, stability, and the ability to motivate innovation.

Read ArticleThanks to its impressive industry expertise, 4Stop, a leading fraud prevention provider, solves businesses riskbased approach through a modern, all-in-one KYB, KYC, compliance and anti-fraud solution worldwide. To celebrate the firm’s win in this year’s competitive FinTech Awards.

Read Article“We’re excited to welcome Paul McManus as our new Vice President Merchant and Payments and Brian Daly as our Head of Product Implementation and Innovation. Paul brings with him 20 years of experience working for some of the world’s leading software companies specialising in.

Read Press ReleaseWe all know doing business online is highly compromised by identity thefts, account fraud, data breaches and various payment fraud. In 2017, 6.64% of consumers became victims of identity fraud – an increase of over 1 million victims from the previous year. Not to mention, managing ongoing.

Read Article“We’re proud to announce today our successful completion of a German-based €2.5M Series A Round from Ventech (the leading pan-European VC fund investing in early-stage tech-driven start-ups) to expand our global KYB, KYC, compliance and anti-fraud technology on an international level.

Read Press Release“We’re excited to have Ian join our executive team during a period of significant growth and innovation. His expertise in sales execution will help us improve our value proposition and deliver relevant and actionable insights." states Ingo Ernst, CEO.

Read Press ReleaseConnect with us at Money 2020 and discover our innovative KYB through to KYC, compliance and fraud prevention solutions - proven to maximise data performance, save time and resources managing KYC and risk mitigation processes and accelerate your business.

Coordinate MeetingIn today’s ever-changing online eco-system that encompasses continuous technology advancements, multiple end-user device implementations and vulnerability to modern fraudsters, the usability of smart technology, like device intelligence, is paramount for efficient, successful...

Watch NowSelected us as a winner of the Best Financial Transaction Security Platform in the FinTech Breakthrough Awards - a premier awards program to recognise FinTech innovators, leaders and visionaries from around the world in a range of categories. 2019 FinTech Breakthrough Award program...

Read Press ReleaseFlashFX is an international money payment service that can transfer to 35 countries across 18 currencies securely, quickly and with no transaction fees. To further enhanced security of their services they have integrated our all-in-one solution to future-proof their risk mitigation...

Read Press ReleaseThe Paypers have releaed this years Web Fraud Prevention, Identity Verification & Authentication Guide. Obtaining global KYC, compliance, big data and fraud prevention is easier than you expected - download our corporate profile from the guide and/or the complete guide to learn more...

Download GuideA look at industry-wide objectives to support our growing payment eco-system and its growing associated risk management. Specifically in how we can improve the speed of merchant set-ups, how quickly we can have quality merchants in the pipeline and how quickly we can verify...

Read ArticleWe've partnered and integrated iovation's device-based fraud detection technology. Through this partnership iovation’s device intelligence technology has been integrated and is operational within the 4Stop KYC suite of data sources and anti-fraud services...

Read Press ReleaseWe've completed and are live with our third phase of our product enhancement. This development focused on expanding the functionality and optimising the user experience surrounding KYC implementation and management to ensure the most simplistic and...

Read Press ReleaseOntology, a new high-performance public blockchain project and a distributed trust collaboration platform, has selected 4STOP to perform Know Your Customer (KYC) on the Ontology trust ecosystem. The two parties will work together to provide digital identity services...

Read Press ReleaseFollowing a comprehensive review of all nominees by Insight Success with consideration of aspects to provide an all-encompassing risk management solution and global services, we excelled and ranked in the Top 10 Most Trusted ERM Solution Providers of 2018...

Read Press ReleaseThrough our new partnership with Web Shield businesses can perform complex, thorough investigations on their merchants. Mitigating any risks hidden within business relationships and obtain a confident, compliant and secure merchant onboarding process...

Read Press ReleaseThrough PAYMENTZ API integration into our KYC, compliance and anti-fraud solution they have expanded their risk mitigation and fraud prevention services for their white-labelled partners and their associated transaction processing...

Read Press ReleaseQuickly review risk within customer registrations and effortlessly manage associated KYC verifications performed, all while ensuring a secure and frictionless onboarding experience...

Read Press Release"Bring KYC and Anti-Fraud For Frictionless Onboarding". The Paypers talks with us about ways of boosting the digital onboarding process with optimal KYC, compliance and fraud prevention measures...

Read InterviewWe're focusing on the importance of KYC and the opportunity of having information on customers. We want to see how big banks can partner with Fintechs when it comes to being compliant, but also to handle customers data...

Watch EpisodeWe've launched phase one of our product enhancement, featuring a new user experience and functionality that will revolutionise how you and your operations team manages and monitors risk.

View Press Release4Stop set out to soothe risk managers’ brows with an end-to-end solution that solves the regulatory pain points. You’re running, but not you don't know where to. Danger lurks in the digital shadows...

View Article“When it comes to sending money across the globe, people want a trusted solution that allows them to not only send money through modern payment methods but to have full confidence their payments are secure and will be...

View Press Release“With the substantial cryptocurrency growth of 2017 and a bright future ahead for digital currencies, we are very excited to be working with GateHub, and to complement their wallet and gateway products with our risk prevention technology....

View Press ReleaseAs further growth in adoption within Blockchain and Crypto market occurs, technology foundations, user expectations and regulatory presence all continue to expand and evolve. A primary expansion we have seen is the regulatory requirements for businesses actively involved...

View Press Release“As an international quality provider of sports betting and online casino services, we have to deal with many and various national requirements for verification and validation of customers. With new regulations enforced we were experiencing the weight it was putting forth...

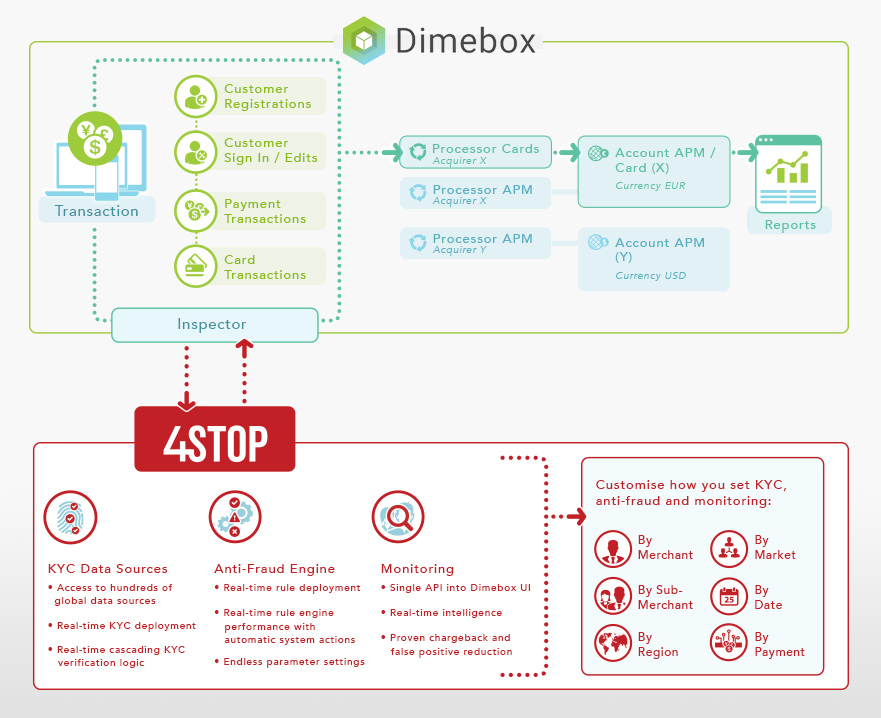

View Press ReleaseThe partnership between payments technology provider Dimebox and 4Stop illustrates how connectivity between platforms creates a plug-and-play PCI Level-1 compliant environment with the 4Stop proprietary risk management technology fully integrated with the Dimebox platform.

View Article Report4Stop is distinguishing itself from its industry competitors by solely focusing on providing global KYC for compliance, in a fail-safe, future-proof, simplistic, and real-time manner. According to the company, the main pain point for the market was the ability to activate required...

View Article Report“We are pleased to be working in close partnership with 4Stop. The 4Stop solution will service all our KYC, compliance, anti-fraud and regulatory requirements. This integration will enhance and protect our payment product”, says MiFinity CEO Paul Kavanagh.

View Press ReleaseDimebox is at the forefront of innovative payment platforms, building all their payment solutions in-house and supporting the ever-evolving, rapidly growing FinTech market announced on September 20th a partnership with 4Stop with a fully integrated solution of the 4Stops proprietary risk management technology.

View Press ReleasePSD2 is the directive that is deeply changing the financial system, especially in the payment services segment. It does not affect only banks and payment service providers, but also companies that are non-bank service providers, like 4Stop. In an environment where traditional banks have no longer the control of the end-to-end value chain, PSD2 is bringing...

View ArticleDiscussing the evolving compliance and its effects it will have on businesses online within the European financial system. "PSD2 – Revised Payment Services Directive – is to cause a disruption to Europe’s financial system. How does it affect 4Stop and the way it aggregates multiple data sources for KYC purposes?

View InterviewAmong more than 100 candidates to ‘SIBS PayForward, 4Stop is one of the 25 startups who will participate in the Bootcamp phase, that will take place in Lisbon, from April 3rd to 7th. These startups come from several countries and areas of activity, namely payments, cards, bank account and personal finance management...

View Press ReleaseAfter a turbulent and unpredictable 2016, the global payments industry has its work cut out to prepare for a flurry of regulatory, legislative and policy reforms in the near future. Due to the requirement for banks and payment service providers allowing secure third-party access to accounts...

Read ArticleTesting and compliance continues to underpin all that the i-gaming sector does well. "Through compliance advances, what was once 'best practices' is now regulatory requirements. At 4Stop our technology allows businesses to not only be compliant today but effortlessly stay compliant tomorrow as regulations continue to evolve. " States Ingo Ernst.

Read ArticleNews

Register for our newsletter and keep your operations team always in the know on trends and industry news relating to global anti-fraud, risk management, compliance and KYC.

We respect your time and inbox and we’ll only send you email correspondence monthly. Sharing with you top industry related news, 4Stop feature updates and up-coming events.

Follow us

Follow us