Why we created 4Stop

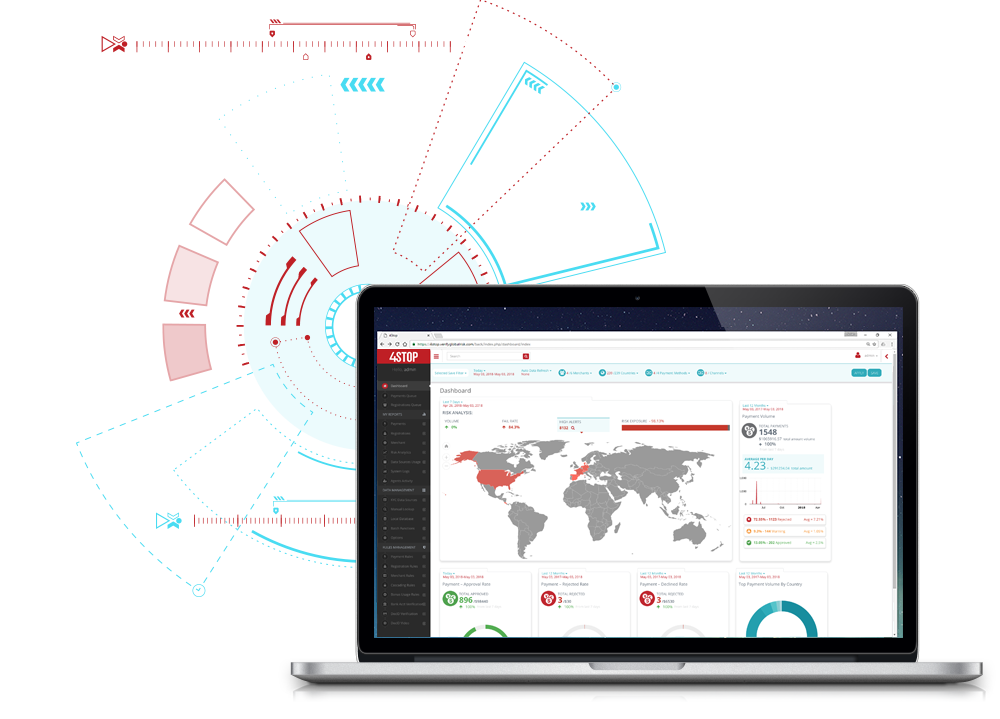

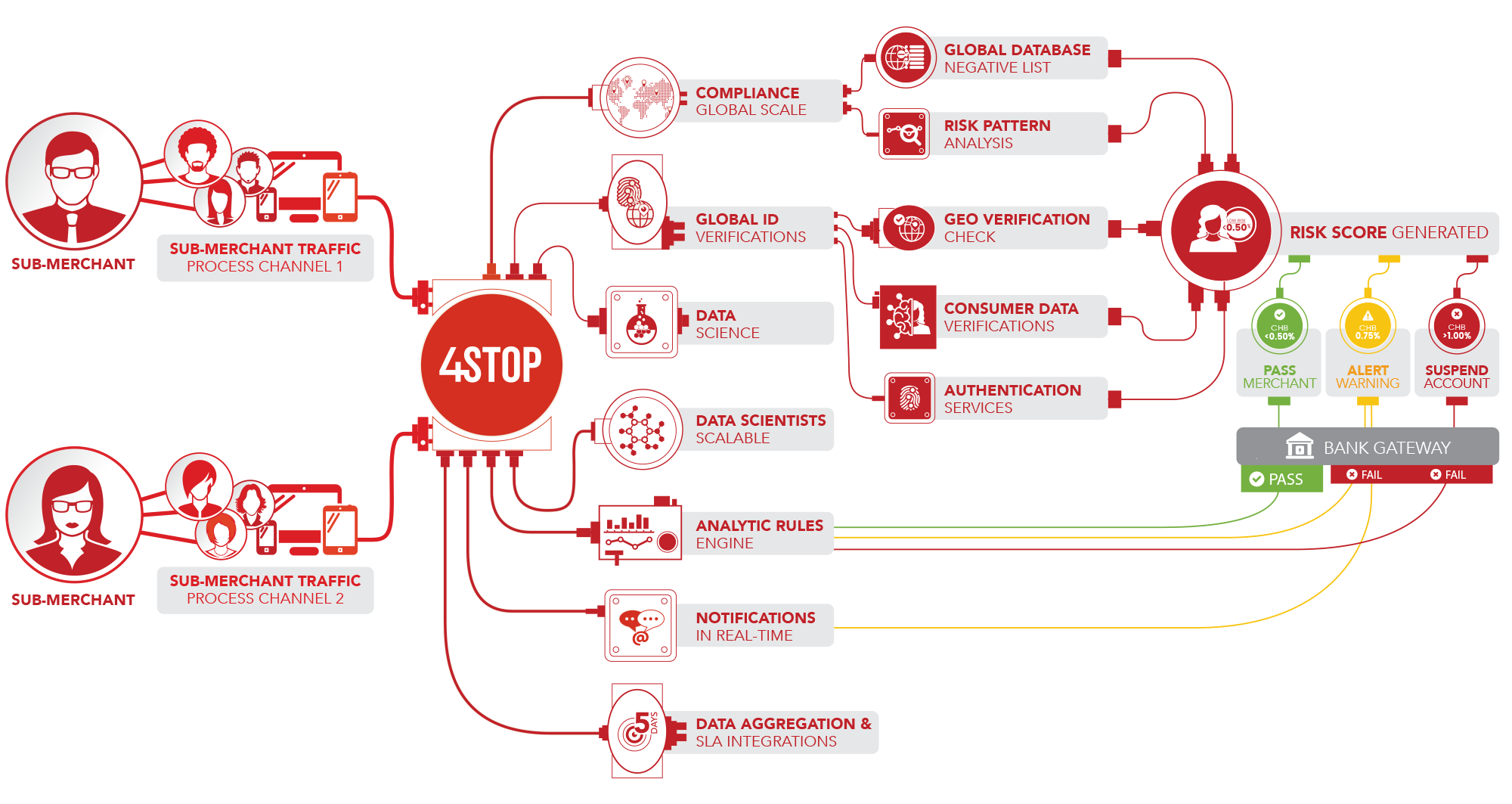

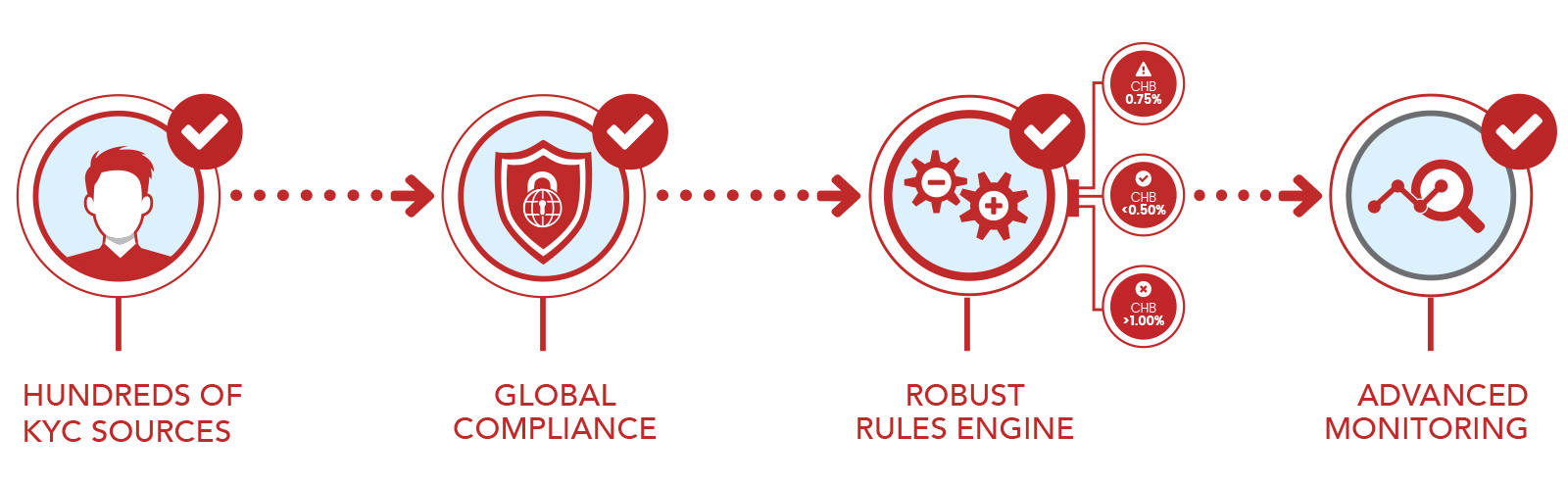

Creating a one-stop solution for enterprise level KYC, compliance and anti-fraud to empower your business to grow with confidence.The primary obstacle in setting up a streamlined risk-based approach and a globally scalable set of data providers for compliant KYC procedures is the challenge of having to integrate various data provider at different touch points in the customer experience. Traditionally this has been solved by various API integrations and Backoffice Management Systems. However, the founding members of 4Stop through their extensive experience in risk and compliance within the FinTech space saw this as a great opportunity and wanted to establish a solution.

A single API integration that provided a single Backoffice Management System with robust flexibility to enable global data sources in real-time, coupled with advanced risk management tools such as real-time dynamic rule sets. We did not know what will all change in the coming years, however one thing was certain, that change will be on-going as the regulating bodies in the various verticals related to online payments continue to tighten their rules and regulations framework to move closer to a fully supervised and compliant payment ecosystem.

"Establishing one product, one platform that not only simplifies and streamlines the risk management and compliance processes but enables enterprise-level businesses to process transactions globally with confidence and compliance as the regulatory and fraud landscapes change was our objective."