Stay Compliant. Grow with Confidence.

Be 4MLD, 5MLD and PSD2 ready, while keeping current with authorities such as:

Global Compliance

Made Easy.

Don't risk non-compliance. We've made

integrating required compliance modern, quick and easy. Through one API integration, you can

activate any KYC required, globally, for regulations.

When regulatory requirements change, simply activate or add any new KYC data source or risk

rule required in real-time or within a 10-day SLA integration to ensure you stay compliant.

Committed To Compliance

Our continued

investment into robust technology, coupled with our advanced 4S regulations team, we are

committed to providing best-in-class KYC and compliance solutions. Working with you to stay

leading-edge, compliant and protected. Be confident, no matter the region or volume.

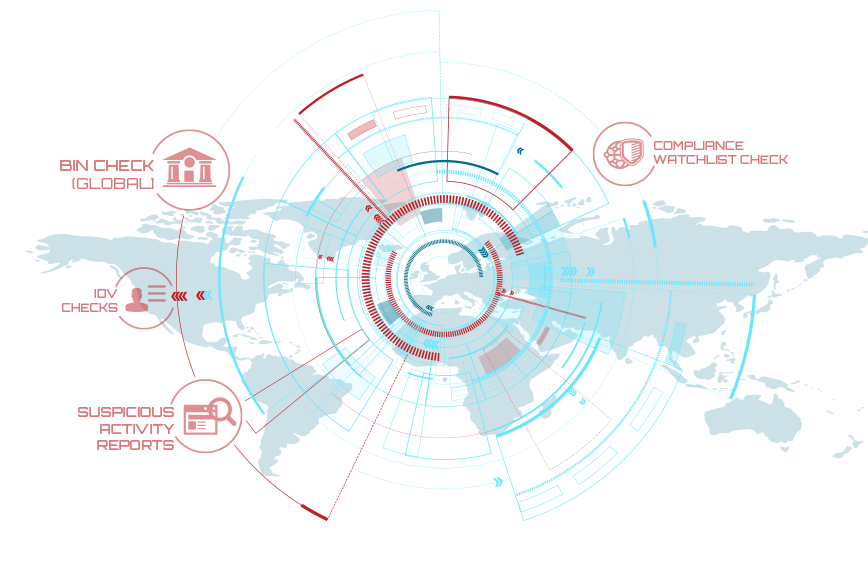

Compliance Watchlist Check

(Global)

Global Sanctions Real-Time Updates | FATF | OFAC | AML/CTF | PEP | RCA | SIP

Compliance Watchlist Advanced

(Global)

Detailed Person Summary on Match Occurrences | Associates | Entities | Roles | Country

Details

Bank Account Check(USA)

ACH | Bank Info | Bank Account Status Check

BVS (Canada)

Soft Credit Check | Profile Data Match to Bureau Credit File: Name | Address | Phone |

DOB | SIN ID (optional)

AML / CTF Reporting

Create real-time reports with built-in threshold alerts to submit on all transactions

required to regulatory bodies.

Suspicious Activity Screening

Robust monitoring and investigation tools to quickly export data to complete suspicious

activity reports.

Flexible Platform

Services

Our platform integrates into any new or legacy platform, provides the largest selection of KYC data sources to choose from and is pre-programmed with thousands of anti-fraud parameters.

Customise Your

4S Solution

Use our complete end-to-end solutions or work with our Data Scientists to design and integrate a solution that is specific to your business' needs and risk management platform.

Obtain 100% of

Possible Conversions

Verify as many customers possible at level 1 KYC vendors before increasing to level 2, 3 and so on. Allowing your business to simply achieve 100% conversions in a cost-effective and frictionless manner.