Managing the Impact of PSD2

Published on April 7th, 2020.

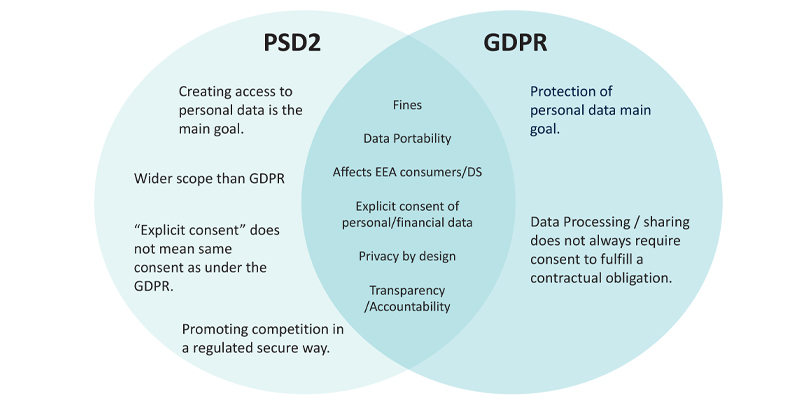

Online consumer behavior and the establishment of PSD2

As more people shop online, fraudsters have been taking note and mimicking common consumer behavior. For instance, in 2019, TransUnion consortium data found a 118% increase in risky transactions from mobile devices. There have also been ongoing shifts in fraud as card-not-present (CNP) fraud continues to increase.(2) In order to protect consumers and businesses, the Revised Payment Services Directive (PSD2) was established in the EU to make cross-border payments as easy, efficient and secure as possible. Other important goals of PSD2 include keeping the cost of transactions down, and fostering innovation and competition within the payment services space. By being PSD2-compliant, businesses can protect their reputations and bottom lines in addition to securing their consumers’ transactions.

Harnessing the benefits of PSD2

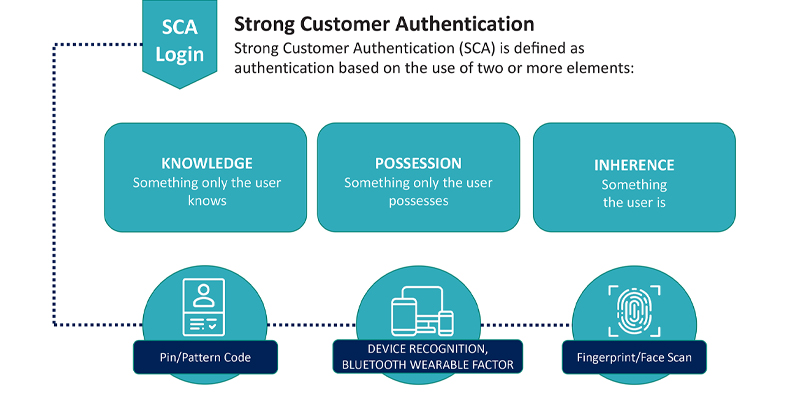

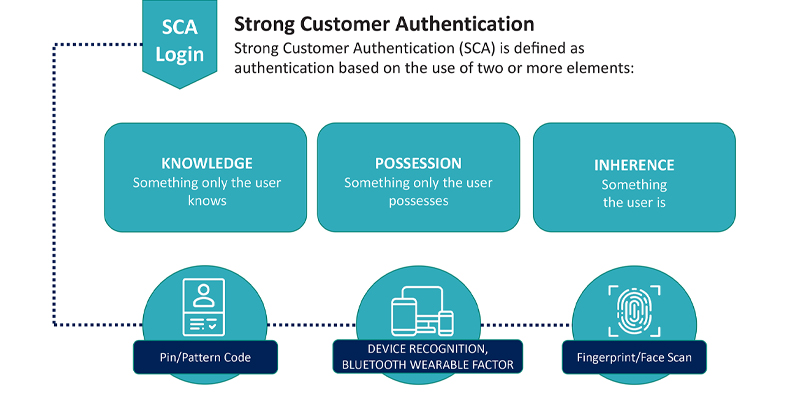

Companies across most industries are under pressure to offer omnichannel access to their consumers. In order to prevent increased fraud, however, these companies need to take the right authentication measures and ensure that they can identify good consumers as well as fraudsters. To this end, PSD2 has encouraged businesses to explore different methods of consumer authentication. For instance, secure login zones can be created when using geo-fencing and time fencing. Alternatively, companies can drive all authentication via mobile, using configurable settings to ensure a friction-right experience for consumers.

PSD2 will also reduce the high risk of data breaches, of which there was an 11% increase in 2018.(1) Companies relying on traditional authentication approaches that are not PSD2-compliant might be increasing their risk exposure by centrally storing credentials, which can easily be stolen. In order to protect your bottom line and build great consumer trust, loyalty and retention, we encourage companies to implement smart technologies while staying in compliance with PSD2.

Optimal authentication strategies in a PSD2 world

Online buying is only going to increase, with online sales projected to make up 17% of all global consumer sales by 2022.(1) By optimising multi factor authentication throughout the customer journey, businesses can be compliant while preventing fraud and keeping bad users out. Worried that increased authentication will lead to consumer friction? Don’t be! 27% of consumers say they’ve actually abandoned a transaction due to a lack of visible security.(3) Consumers don’t just want quick turnarounds on their purchases, they also want to see that businesses are taking the necessary steps to keep their information secure.

TransUnion and 4Stop can provide the strong multifactor authentication and fraud prevention tools you need in order to be PSD2-compliant. To learn more about PSD2 from 4Stop and TransUnion compliance experts, watch our webinar here.

+

+

Follow us

Follow us