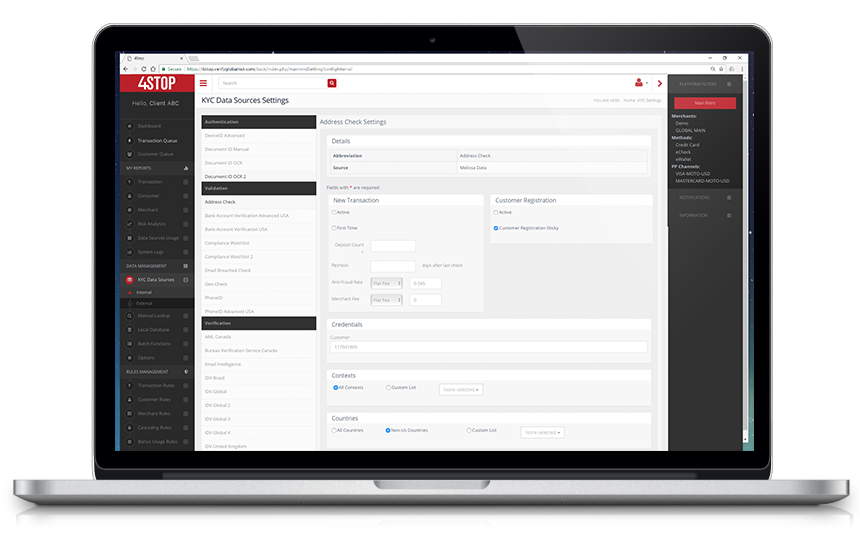

400+ integrated world-class

KYC data sources

Access the largest selection of KYC data services available globally from just one integration and automatically obtain compliance and premium anti-fraud protection.

- End-to-end KYC packages for compliance

- Instantly activate and deploy KYC in real-time

- Automated cost-savings KYC waterfall logic

- Global coverage to enter new markets with confidence

- Flexible to bring your own data or your own pricing for external checks

Don’t risk non-compliance

We make it quick and easy

Be 4MLD and PSD2 compliant in just a few clicks, while staying current on all required regulatory authorities such as Bafin, FCA, Fincen and Fintrac.

Compliance At All

Touch Points

Be 4MLD and PSD2 complaint at each and every customer touch point from sign up, logins, account updates, to transactions. We have you fully covered.

AML Monitoring

& Reporting

With real-time monitoring, customised alerts and quick filters on reporting you can streamline the submition process to required regulatory bodies.

Future Proof to

Stay Compliant

We are always adding new KYC data sources to our platform, allowing you to instantly activate KYC data services required as regulatory requirements evolve.

Integrated smart transactions

with world-class fraud prevention

Our 4S anti-fraud technology gives you everything you need to secure customers and transactions to protect your business and combat fraud.

Powerful Rules Engine

Optimise rule configuration with 800+ pre-designed rules, a simple rule configuration wizard, full control on rule weighing, and system action responses, layered with the ability to deploy in real-time.

Time-Frame Intelligence

Need a custom blocking, rule or system action parameter to be applied for a specific region and / or duration? No problem. Our platform gives you full customisation and control to do just that.

Automated Responses

Our platform does the work for you. Set parameters to apply automated real-time system actions based on the outcome and risk scores of validations performed on your customers and their transactions.

Enriched Data Filters

We make it easy to apply a rule configuration, database management or system action to one customer group or all in a single click. Through our platforms enriched data filters you can apply your actions to exactly whom you need in just a few seconds.

Association Logic

Instantly identify shared accounts across unique and global networks through the use of risk rules, numerous attributes in full, fragments and time-frame intelligence with the ability to automatically apply system actions for optimal protection.

Data Simulation Analysis

Whether you want to expand into a new market, region or adjust fraud prevention based on trends, easily create and review whole market profiles with the ability to collaborate and activate required KYC data sources and rules instantly to support.

Improve reaction times

Real-time intelligence monitoring

Through fully integrated anlaytics with a wide range of KPI dashboards, platform filters, notifications and detailed reports, you'll know exactly what is going on all day, everyday.

Real-time Intelligence

Through one integration, enjoy a single view of risk with auto-refreshed monitoring of registrations, declined rates, chargebacks and much more at both merchant and consumer level.

Multi-layered Monitoring

See it all, from detailed customer profiles and transactional history, comprehensive rules output reports to case reviews with a wide range of data vendor responses.

One-Click Reviews

Triage your traffic with ease. Instantly targeted one-click review queues configured for any criteria with performance monitoring for complete history profiling backlog.

One-Stop Solution

We eliminate the inefficiency of multiple platform integrations to acquire the levels of KYC and anti-fraud processes required. Our 4S Platform has been designed by risk specialists to make KYC, compliance and anti-fraud as seamless and accessible as possible.

Make Compliance Easy

Regardless of your industry, knowing your compliance requirements, implementing those requirements and staying compliant should be as easy as possible. Use our end-to-end KYC for compliance solutions or compliment your existing risk platform, to do just.

One Simple Integration

Our platform integrates into any new or legacy platform with ease. Designed by developers for developers our simple REST API provides strong definition and code examples in all major programming languages to have you integrated in hours and not days.

Follow us

Follow us