How New Regulations Affect the Digital Financial System in Europe.

Excerpts From Alvaro Kruth, CRO at 4Stop. Article by Medici

PSD2 is the directive that is deeply changing the financial system, especially in the payment services segment. It does not affect only banks and payment service providers, but also companies that are non-bank service providers, like 4Stop.

In an environment where traditional banks have no longer the control of the end-to-end value chain, PSD2 is bringing an evolution in terms of digital identity management and control, customer authentication, KYC and compliance requirements.

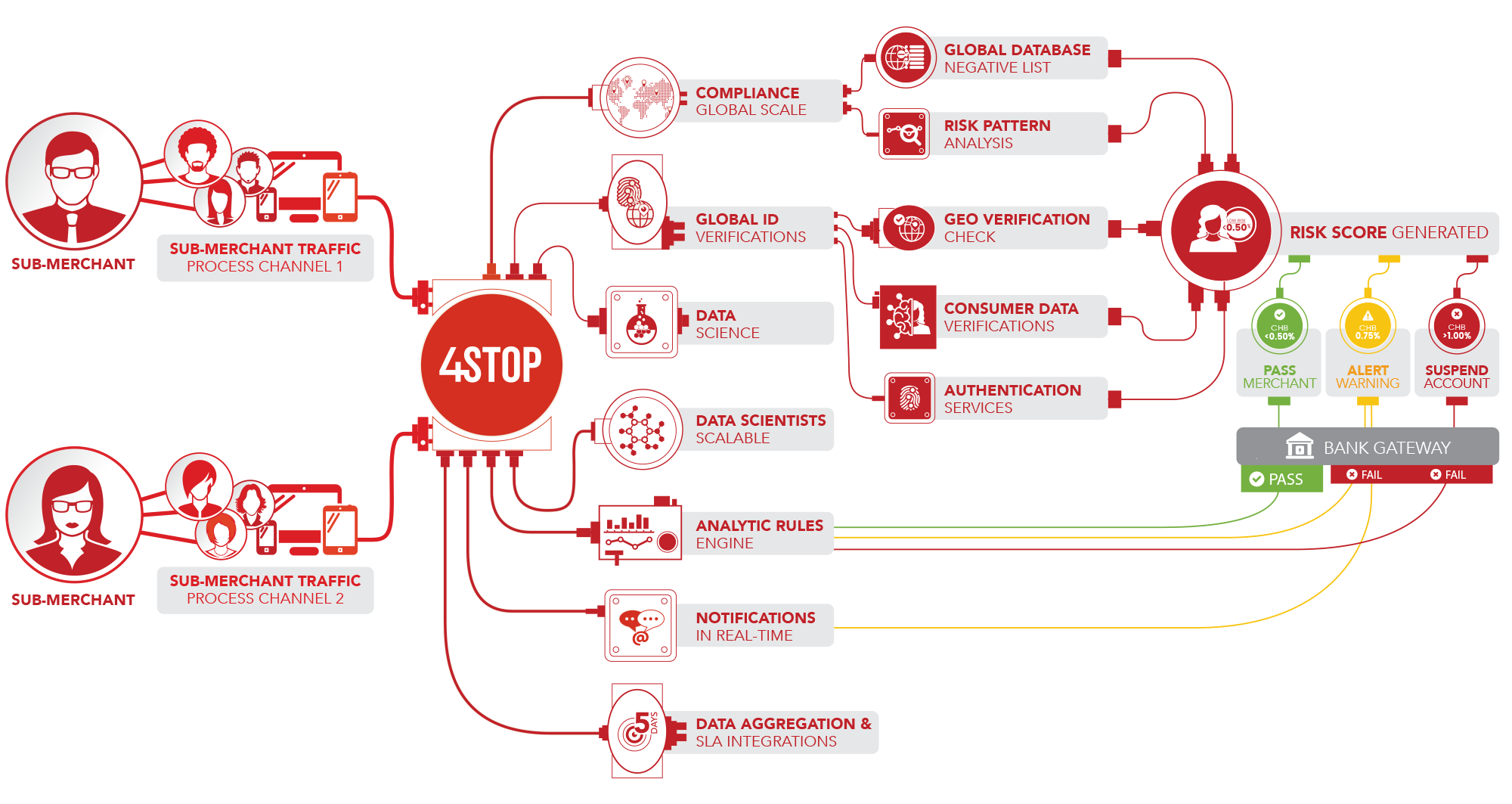

The 4Stop One-Stop Solution.

In this revolution, companies like 4Stop provide solutions that optimize the way data is aggregated throughout multiple sources. Businesses that rely on 4Stop and other service providers can now meet current KYC and compliance requirements, and, more importantly, be sure that they will meet requirements also in the future when regulations will change and evolve – all of this without any effort from the business.

PSD2 will also contribute to increasing trust in consumers that will be more confident in releasing data to third party providers. In fact, PSD2 interrelated with other legislative and industry developments, allows member states to reduce borders and have transparent transaction data, a single set of rules, and a lead supervisory authority. In this way, PSD2 will result in increased availability of consumer transaction data.

With PSD2, banks and payment service providers need to change in order to comply with the new regulation, meeting technical requirements imposed to authenticate individuals. Otherwise, they would not be authorized to keep operating within the EU. The implementation of PSD2 will also contribute to building new relationships between organizations in regards to data partnerships, and protect consumer interests.

The adaptation process to new directives, requirements, and regulations is an ongoing process with potential delays when enforced by the competent authorities. And here comes the advantage of a third-party provider like 4Stop, that easily adapts to an always-in-change global environment and helps banks and payment service providers to adopt real-time solutions – so FIs and PSPs will not have to worry about regulatory challenges and changes.

Another regulation that will be implemented next year aside from PSD2, is GDPR. PSD2 and GDPR present some overlaps in terms of third-party data sharing regulations. New developments are going to take place, and technologies will have to stay updated and flexible to adaptation.

PSD2 and GDPR will complement each other and we will see the increase in consumer confidence in KYC, protection of data, improvement in data authenticity.

The global financial landscape is changing and it is fundamental to keep the pace to not lose any opportunity.

Follow us

Follow us