One API Is All You Need.

KYB, KYC, Compliance and Anti-Fraud.

4Stop aggregates trusted information,

managed services, data, software and expertise to establish a next-generation all-in-one

KYB, KYC, compliance and anti-fraud solution.

Through one API access thousands of global data points, hundreds of global KYC data sources,

harmonised data science and 4Stop's proprietary real-time anti-fraud and monitoring

technology.

THE 4STOP SOLUTION

Automated,

Real-Time KYB.

Underwrite businesses with results in under 7 minutes. Combined with enhanced real-time KYC on directors to verify every merchant for seamless onboard.

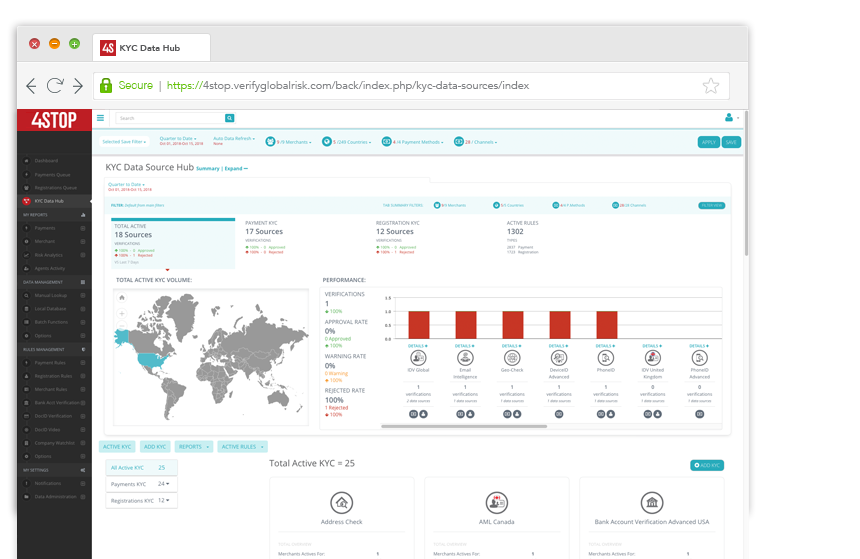

Hundreds of

KYC Data Sources.

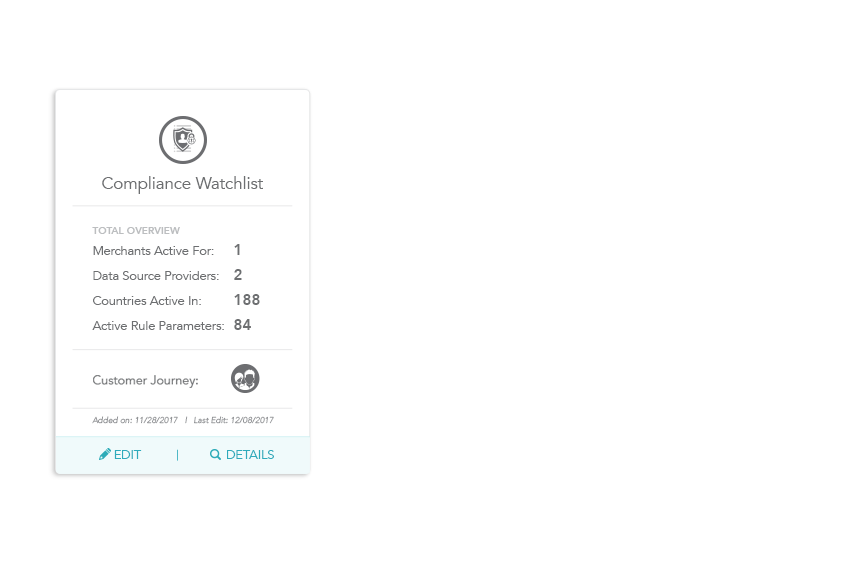

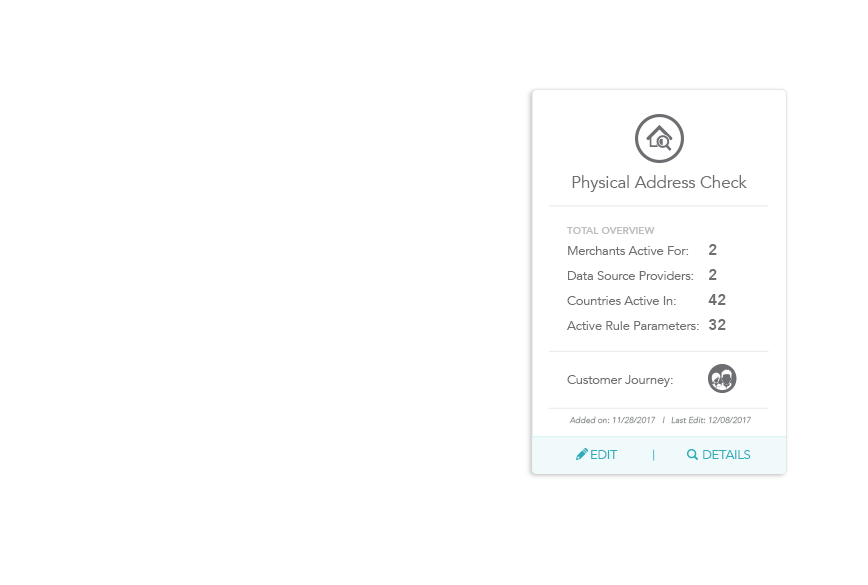

Hundreds of global KYC data sources with real-time activation and cascading verification logic for cost-savings and the best data experience possible.

Instant

Global

Compliance.

Effortlessly manage compliance regardless of the ever-changing regulatory landscape with on-demand KYC and granular one-click compliance reporting.

Multi-Faceted

Rules Engine.

Automate anti-fraud through our advanced rules engine with 800+ pre-determined rules, free-form scripting, real-time deployment and cascading performance.

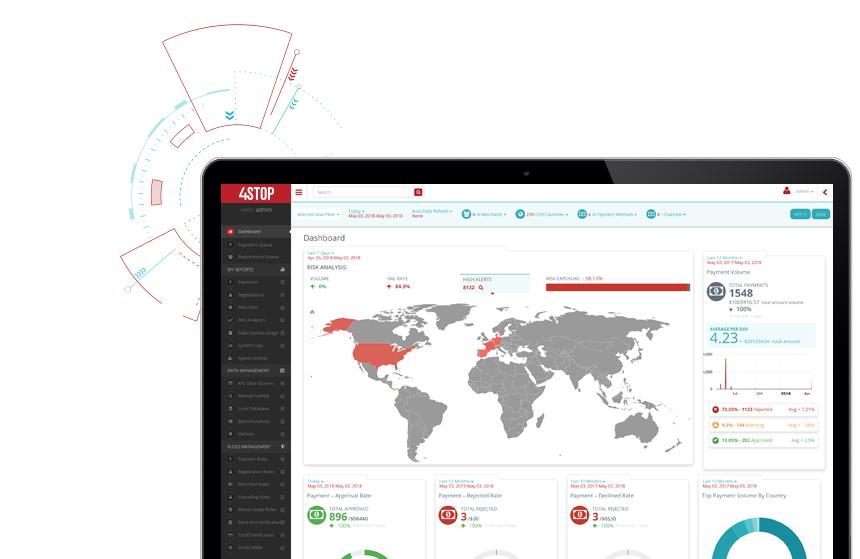

Real-Time

Monitoring.

Enjoy a single-view-of-risk of all KYC and anti-fraud performance with real-time intelligence and fully customisable dashboards with advanced filtering.

Harmonized

Data Science.

Add our solution to your KYC integrations and maximising your global data points and data performance capabilities in a frictionless manner, from a single API.

Enterprise-level solution to fully support and scale to your customers and transaction volume.

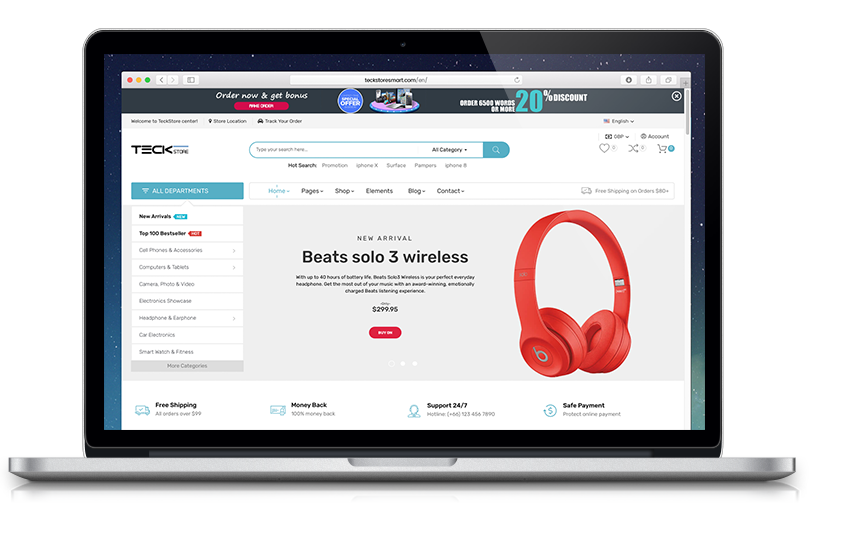

Automated KYB.

Underwrite Merchants With Ease.

Advanced mirroring technology

investigates your merchants' online presence in near real-time through open source

intelligence. Within 7 minutes you’ll receive a thorough assessment regarding their

overall website presence with clear risk indicators.

Combined with enhanced real-time KYC performed on directors, you'll obtain comprehensive

reports and intelligence to streamline the verification process for every merchant you

onboard.

- Money Laundering Detection

- Merchant Location Determination

- Compliance Sanctions & PEP Screening

- Category Code Detection

- Deceptive Traffic Detection

- Historical Website Data Analysis

- Predictive Risk Analysis

- Enhanced KYC On Directors

- Automated On-Going KYB Re-Checks

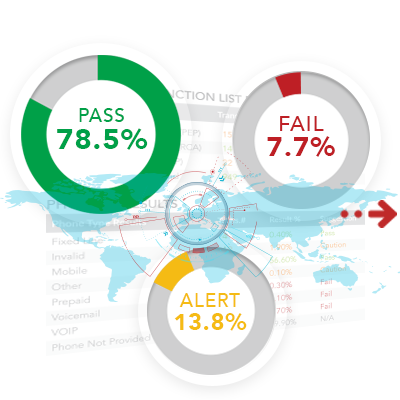

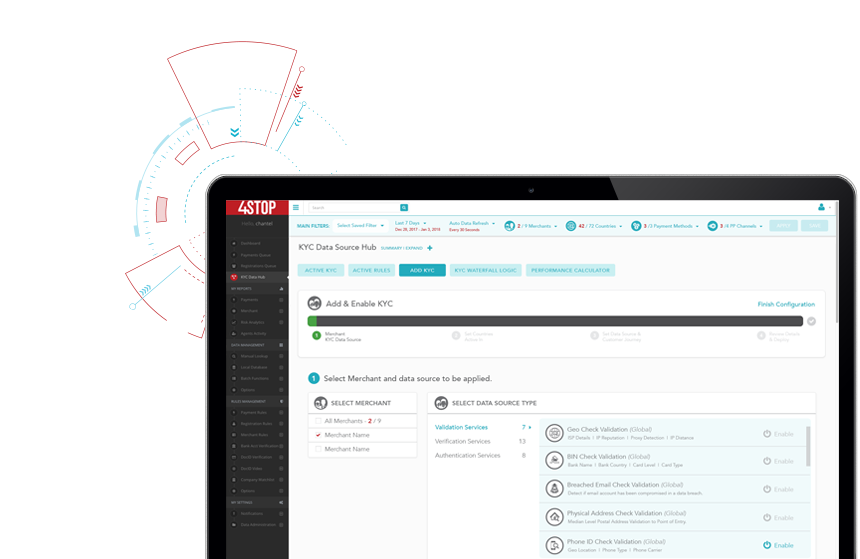

KYC Made Smart.

One Integration. Hundreds of KYC.

Real-time Verifications and Analysis.

Our KYC technology eliminates

cumbersome, costly and inefficient KYC processes.

With the ability to activate KYC required in minutes, through to configuring associated

dynamic anti-fraud and receiving granular KYC performance analysis, you'll easily manage

KYC requirements on a global scale.

Instant Compliance.

Effortlessly Manage Global or Localised Regulatory Obligations.

Through a single API, have global compliance coverage by having access to hundreds of KYC data sources with the ability to activate them in real-time. All backed behind 4Stop's rich data output, establishing fully customised reports for regulatory bodies is quick and easy.

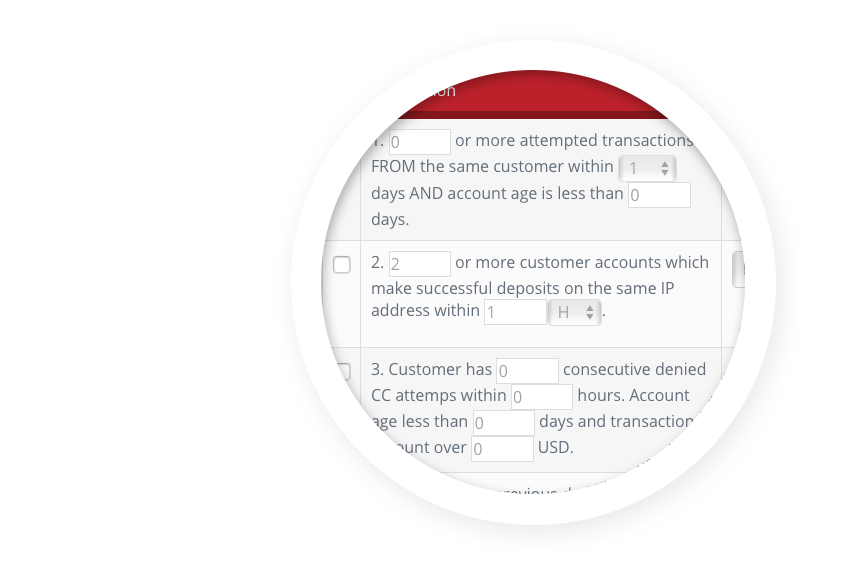

Multi-Faceted Rules Engine.

Anti-Fraud With Automated Intelligence.

4Stop’s proprietary real-time anti-fraud and monitoring technology allows you to monitor your traffic from a single-view-of-risk with quantifiable data and real-time intelligence. The rules engine is designed with robust feature-rich technology to allow dynamic checking and securing of customers and their transactions.

- 800+ Pre-Determined Rule Parameters

- Free-Form Rule Scripting

- Cascading Rule Verification Technology

- Automated Responses and System Actions

- Time-Frame Intelligence

- Association Logic

- Fully Integrated Analytics

- Real-Time Intelligence and Monitoring

- Customised Exportable Data Reports

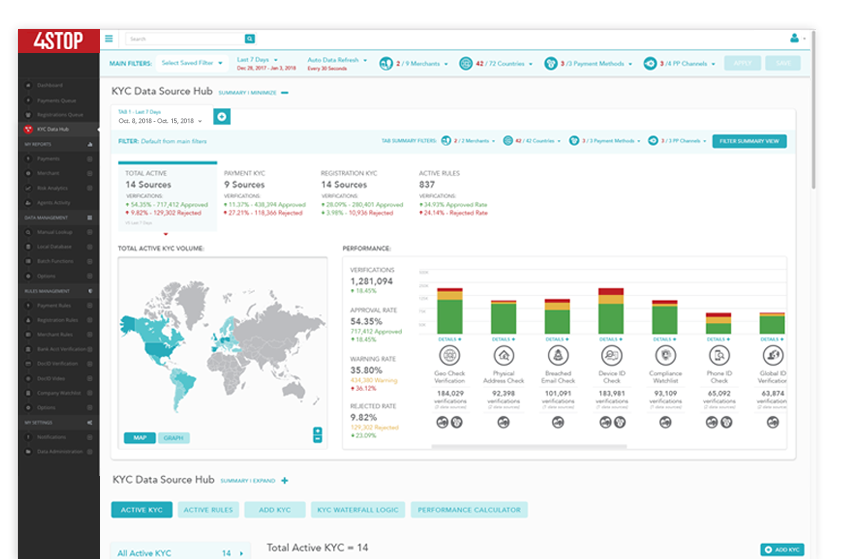

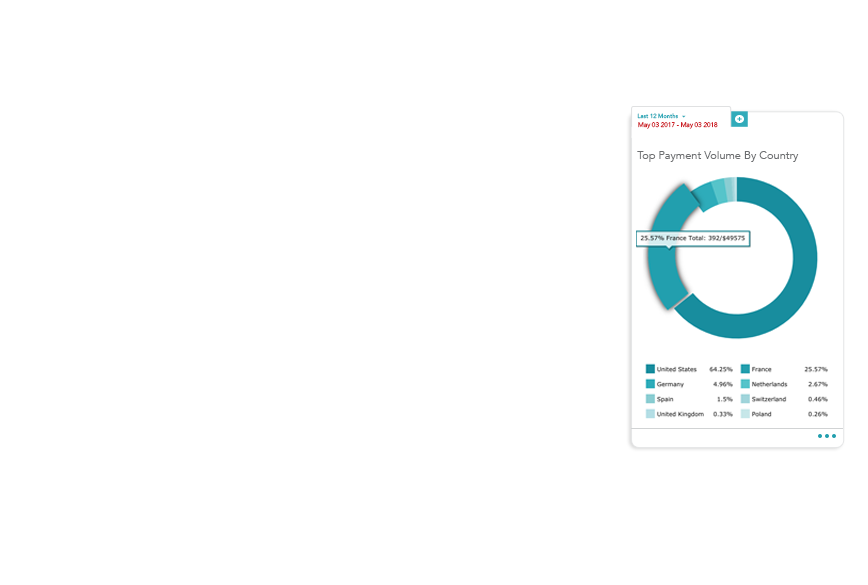

Improve Reaction Times.

With a Centralised View-of-Risk.

Know exactly what is going on everyday, all day. Through fully integrated anlaytics and the ability to one-click activate widgets from the hundreds of pre-determined reporting widget library and reposition widget placement you will fully customise your dashboard experience to optimise your monitoring processes. Paired with the systems robust filter options and tab review functionality, to effortlessly drill down to exactly the data you want to review and/or compare. We make monitoring simple and enjoyable.

Real-time Intelligence

Through one integration, enjoy a global centralised view of risk with auto-refreshed monitoring of registrations, payment volumes, declined rates, chargebacks and much more at both merchant, sub-merchant and customer level.

Multi-layered Monitoring

See it all, from our risk analysis dashboard, detailed summary reports, customer profiles and transactional history, comprehensive rules output reports, to case reviews with a wide range of data vendor responses.

One-Click Reviews

Triage your traffic with ease. Instantly targeted one-click review queues configured for any criteria with performance monitoring for complete history profiling backlog. Coupled with the ability to generate customised export and reports.

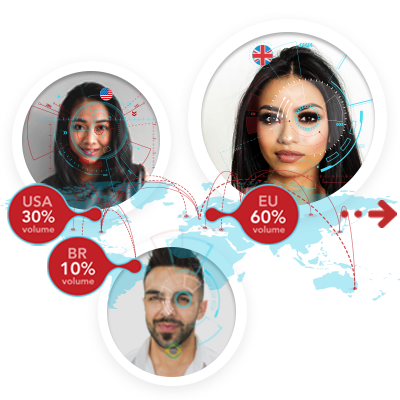

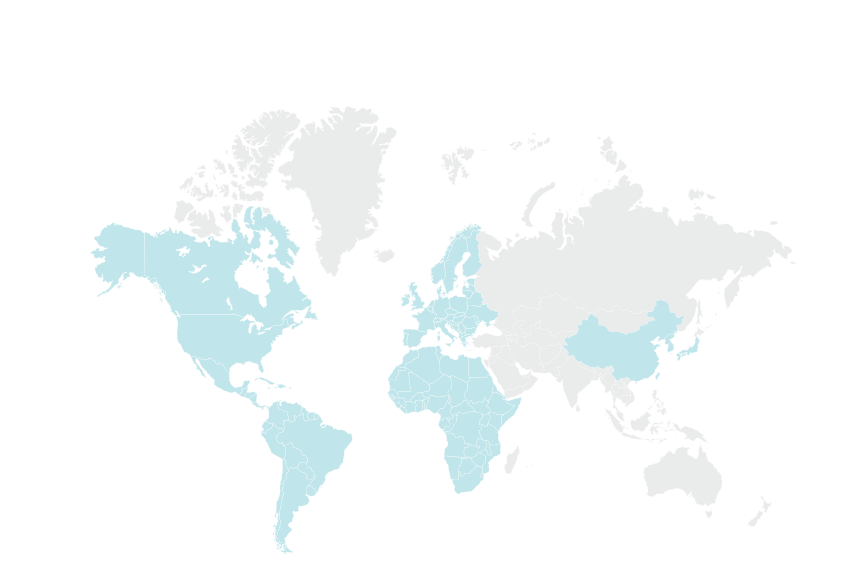

Premium Data Aggregation.

Thousands of Global Data Points.

Add our solution to your KYC integrations and maximising

your global data points and data performance capabilities in a frictionless manner.

Through our data science establish full market profiles and risk rule simulations. With

comprehensive data simulation reports you can make quantifiable decisions to confidently

expand globally and / or optimize your current KYC data performance and fraud prevention.

Centralised Global View of Risk and Checks.

How our all-in-one risk and compliance market solution works.

Challenges in KYB, KYC, Compliance and Anti-Fraud.

It can be a cumbersome and costly process to implement the necessary verifications for underwriting businesses, through to verifying their customers and transactions with required KYC for compliance and fraud prevention.

SLOW MERCHANT ONBOARDING

A recent report stated the average onboarding times to ensuring businesses and directors are properly verified for AML, compliance, and fraud prevention is 26 days and growing.

LACK OF AUTOMATED KYC

KYC is being solved through multiple integrations with a high degree of manual intervention and review with little ability to automate KYC activation or harmonise the data performance.

GLOBAL COVERAGE

It is a cumbersome, costly and inefficient process to integrate and manage required KYC for compliance for true world-wide coverage or per localized regulation.

HIGH IT DEPENDENCE

Ensuring accurate KYC for compliance comes with an array of multiple integrations that causes IT development resource strain, increases costs and delays market entry.

4Stop Use Cases

Our continued investment in robust technology means that clients can confidently integrate with an organization at the forefront of leading-edge KYC, compliance, risk technology to keep your 4S solution effective and cutting-edge.

Businesses that have utilized 4Stop’s anti-fraud technology experience a 66.6% reduction in chargebacks in the first 2 months with an average of 81.5% approval authorization rate.

With 4Stop's real-time cascading KYC verification technology, businesses have seen a growth of 10.9% in savings within the first 2 months.

- Chargeback Reduction:

%

- Authorization Rates Increased:

%

- Savings Increased:

%