Seamlessly onboard your businesses with trust and confidence from a single platform solution - saving you time and money.

Web Analysis

Receive thorough assessment on the business online presence with risk indicators flagged, score ratings and recommendations for optimal review process.

Learn More

Credit

Receive comprehensive credit reports on businesses around the world. Reports encompass a clear understanding of the business credit score and credit limit.

Learn More

Compliance

Receive all required business documentation including annual accounts, registered checks and reports, articles of association, and shareholder information.

Learn More

Verify UBOs

Apply any of our hundreds of real-time KYC checks including identity document verification and sanction screenings on UBO's, directors and shareholders of the business.

Learn More

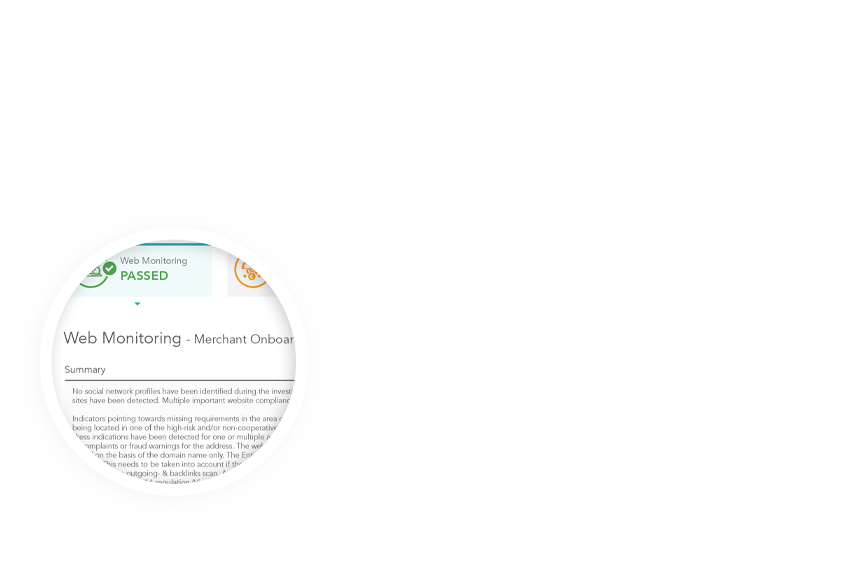

Investigate Online Presence

Real-Time Results In Minutes.

Advanced mirroring technology investigates the business website in near real-time through open source intelligence. Within 7 minutes you’ll receive a thorough assessment regarding their overall website presence with clear risk indicators flagged, score ratings and recommendations to ensure optimal review process.

An Array Of Website Analysis Investigation Tools.

MONEY LAUNDERING

DETECTION

Through a myriad of methods we identify and classify all websites that may not have been communicated, but are connected to the business. Allowing you to uncover any transaction laundering risks within these website(s) relations.

Business Location

Determination

The report includes granular details to verify the business registered address, VAT, director location, contact details, server location, licensing area, currency, audience and governing law.

Compliance Sanctions &

PEP Screening

Ensure you do not unknowingly conduct business with sanctioned individuals or organisations by performing real-time global sanction checks across FATF, OFAC, AML/CTF, PEP, RCA, SIP and adverse media lists on a daily, weekly or monthly basis.

Category Code

Detection

Detect Business Category Codes and identify the industry in which they operate within to mitigate any risk if the business operates within a high-risk framework so you can make a quantifiable decision to onboard them through further due-diligence.

Deceptive Traffic

Detection

Through the website analysis performance and content risk evaluation, you'll know when a business may be utilising deceptive marketing to push their products or services, if there are any content violations present and if website compliance is adhered to.

Historical Website

Data Analysis

Receive detailed information on the business website presence going back more than 5 years including overall website presence scoring, engagement sources, user traffic, content violations, enforced website compliance and server and IP information.

Predictive Risk

Analysis

Through the systems risk engine combined with historical website data analysis, you will receive a dynamic calculation of the probability for future violations regarding content, adhered compliance, transaction laundering, chargeback rates and much more.

Enhanced Underwriting

Risk Analysis

Expand your research by utilizing an underwriting representative that will further assess all content violations, business websites, background research activities, website compliance, virtual office(s) and payment processing pages, all within 36 hours.

Keep A Positive

Portfolio On-Going

At any point during your relationship with your onboarded business, you can perform dynamic daily, weekly or monthly underwriting analysis. Allowing you to ensure that your business's website presence and engagement remains positive for your business.

Know Of Any Credit Risk & Exposure.

Credit Reports

Understanding a businesses financial stability at the point of onboarding is the greatest predictor of how they will engage and their future payment behaviour. Receive full credit reports on businesses and UBO's around the world with financial history performance and credit limit intel to ensure your business and portfolio are protected.

Company Data

Extensive coverage of business type, address, number of employees, primary SIC code industry classification, years in business, annual sales amount, regional and federal tax liens, UCC filings, government awards, judgments and bankruptcies intel. Databases are continuously being updated to ensure the most accurate data is obtained.

Predictive Scoring

You not only receive their current risk score but a clear understanding as to how they will engage with you. Through advanced risk scoring that encompasses all of your KYB data-driven results and key statistical metrics based on current and historical payment behaviour to predict 70% of company insolvencies 12 months in advance.

Dramatically Decrease Your Onboarding Times.

Instant real-time access to global structured, official and authoritative commercial register data.ENSURE COMPLIANCE

Automated retrieval of company data worldwide for compliance and enhanced due diligence (EDD). Receive business registry documentations, articles of association, shareholder information, and annual financial accounts.

WORLDWIDE COVERAGE

Coverage over 90+ countries and jurisdictions with real-time instant access to documentations. Expanded to 115 jurisdictions through a custom concierge service providing commercial register information quickly and efficiently.

LIFETIME DUE-DILIGENCE

Stay compliance with ease. Our databases are continuously updated and addressing on-going checks is fully automated with custom notifications that will instantly inform you if a company has surpassed their risk threshold.

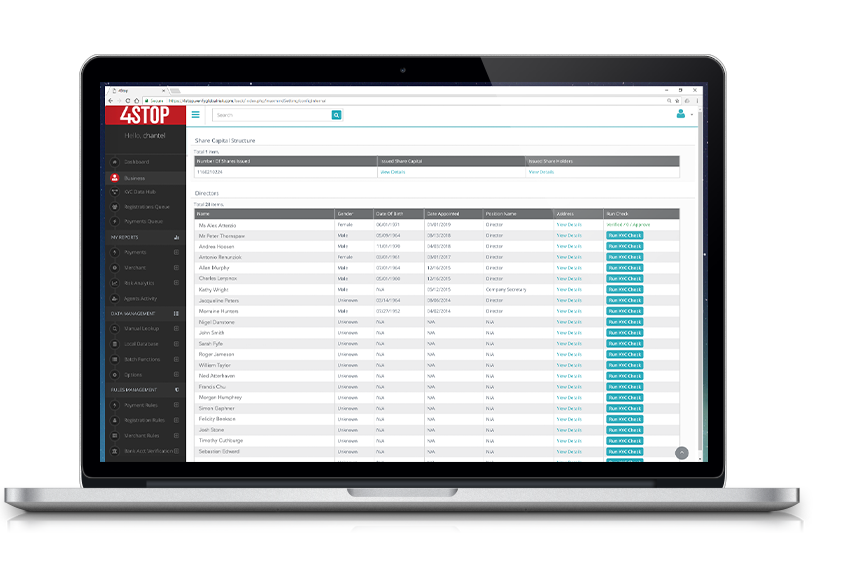

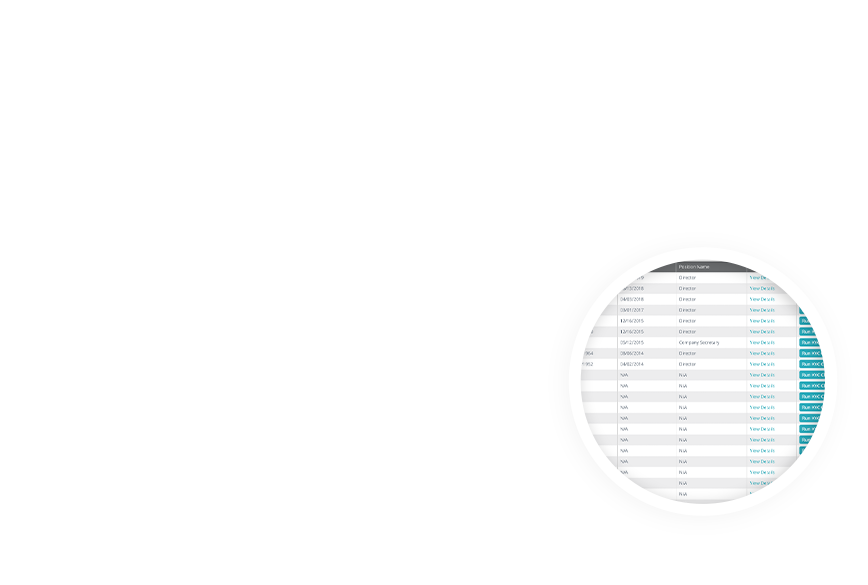

Enhanced UBO / Director

Due Diligence

With Real-Time KYC.

Expand your research into a business UBO / Director / Shareholder by enabling and performing real-time KYC verifications. In one click instantly perform compliance watchlist screenings and document ID verification. Paired with an array of global KYC data sources readily available if you choose to perform further KYC verifications.

Fully Automated KYC

Effortlessly activate, deploy and perform any of the global KYC data sources available in an automated and real-time manner. Alongside numerous automated system actions including instant blacklist from first verification point, streamlining your risk mitigation processes.

World-Wide Coverage

We've integrated hundreds of KYC data sources to provide true worldwide coverage and optimal enriched data experience. Allowing you to confidently process your KYC for compliance and due diligence regardless of the global region and make quantifiable decisions.

Real-Time Verifications

Enhance your underwriting in minutes with real-time results. Our KYC data hub is fully automated and can deploy your KYC required, alongside associated risk rules all in real-time, at a specific time or through our time-frame logic with real-time results.

Document Verifications

With global coverage automatically verify ID documentation of UBO's, directors or shareholders for quality and formatting, while also reviewing documentation for scrapped data. Comes with an upload facility, file management and smart review tools.

Credit Reports & Limits

Through our KYB global credit data source you receive reports on UBOs and Directors of the business that encompasses full name, address, date of birth, nationality, appointment and resignation dates, current and previous appointments fully verified.

Detailed Director KYC Reports

Review all director specific KYC verifications performed along with their full in-depth profile, risk score and verification data results. These reports are readily available from within the KYB specific business profile investigation interface.

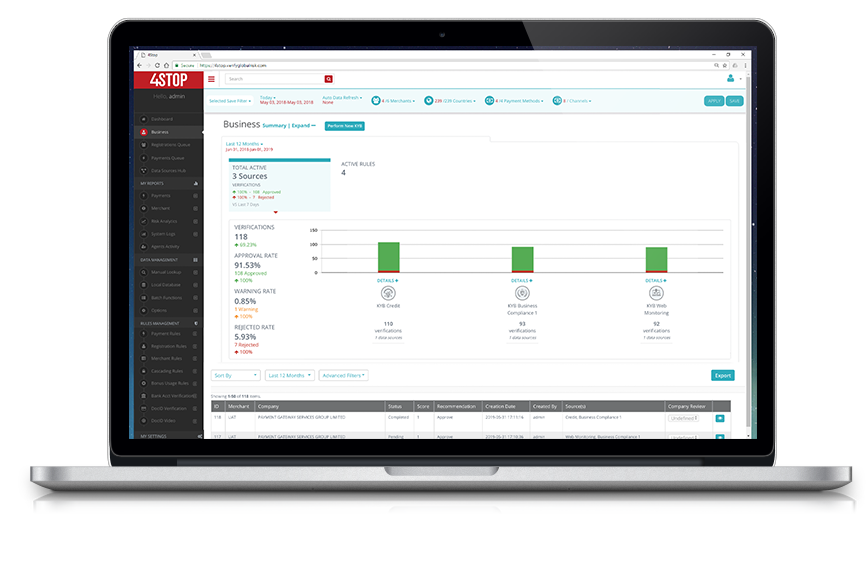

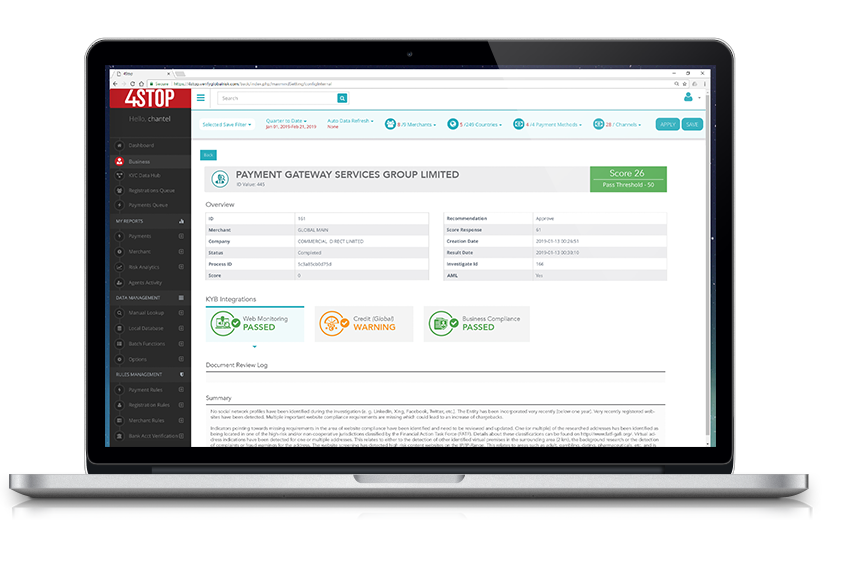

Underwriting Analysis

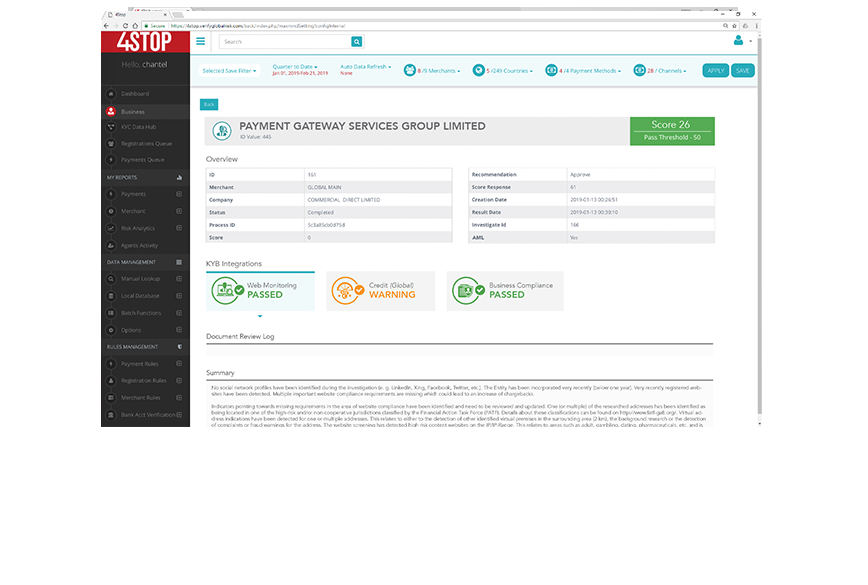

With Global View Of Business Checks.

Through a dynamic customisable dashboard and a KYB specific queue hub, you can view and manage all activated KYB investigation reports with their associated data performance output. Paired with the ability to easily activate in real-time additional KYB required.

Quick Summaries of Status

Through the KYB queue instantly view business underwriting high-level reports indicating the ones that are presenting low to high risk to streamline your review.

Step-By-Step Activation

We make it as easy as possible to begin your KYB by guiding you through the entire process from initial activation through to running the investigation.

Real-Time Intelligence

Easily view current and historical underwriting data including; all verifications performed with holistic and data source specific associated data performance output, overall risk exposure analysis, underwriting reports and much more.

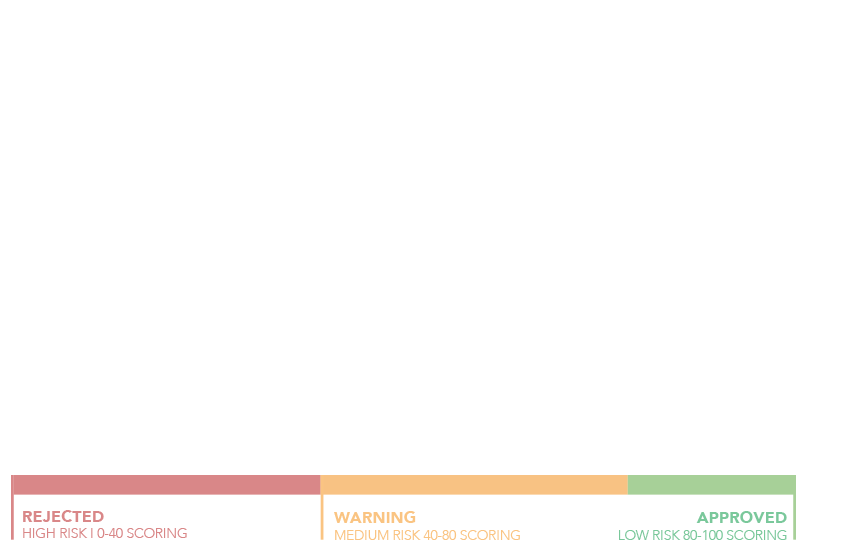

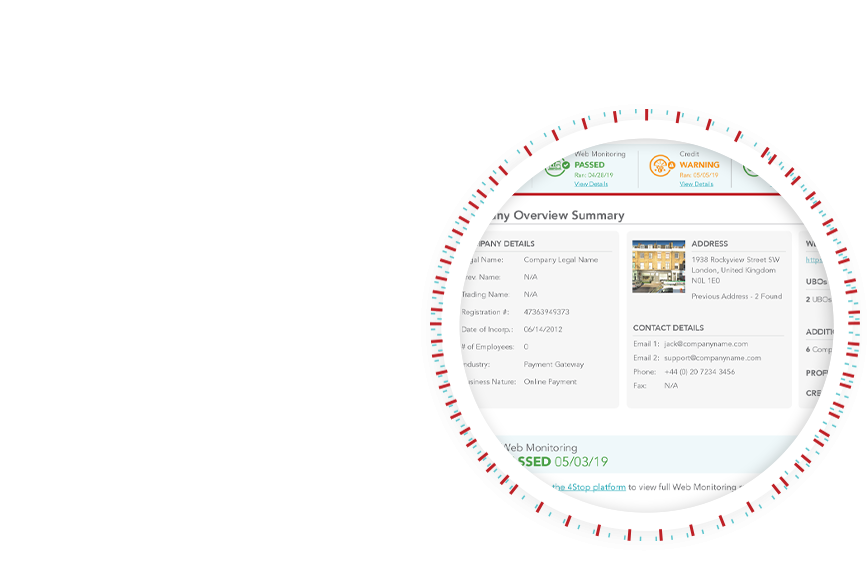

Simple and Clear Risk Flags

and Recommendations.

Stay organised and streamline your underwriting review process. From a singular business specific profile interface, you can easily view and manage all underwriting reporting documentation from website analysis, enhanced KYC on directors, site history output, case files and more.

All Your Business Underwriting Files

In One Place.

Stay organised and streamline your underwriting review process. From a singular business specific profile interface, you can easily access deep-dive reports on all KYB verifications performed and documents obtained.

- Risk score with indicators of threats and risks

- Clear risk resolution recommendations

- Comprehensive KYB reports

- View director(s) KYC profile and verifications

4Stop is dedicated to supporting your business onboarding in the most streamlined and efficient manner possible. To learn more about our solution and to schedule a personalised 1:1 demo please contact a representative today at sales@4stop.com for more information.