Smart KYC Solutions

For Confidence and Peace-Of-Mind

From validating, verifying and authenticating your customers, 4Stop provides you all the KYC you require. From a single API you have access to the hundreds of aggregated KYC data sources within 4Stop's KYC data source hub for true world-wide coverage. Coupled with the ability to activate them instantly and configure real-time cascading KYC verification logic you'll onboard your customers and verify their transactions in the most cost-efficient and effective manner possible.

Onboarding Pre-Screening Package

Device ID

(Global)

Bring further awareness of your customers through device hardware fingerprint, java based, and granular device details. Providing first defence against fraud from the device up.

Device ID Advanced

(Global)

Utilising all aspects of Device ID to enhance customers digital profiles combines with detailed device reputation data for extra authenticity of customers.

Geo Check

(Global)

Validate the authenticity of your customers coordinates through our geo checker to provide you with ISP details, IP reputation, IP distance and proxy detection.

Breached Email Check

(Global)

At sign up and any account updates we check emails provided are not at a high risk of exposure and have not been compromised through any data breach.

Email Verification

(Global)

Review email accounts in detail from type of email address, age of account, customer profile, domain intelligence and the emails reputation standing.

Phone ID Check

(Global)

We’ll check the number, the phone type and its carrier. In conjunction with the phone’s accurate geo location and have accurate contact details.

Complete KYC Package

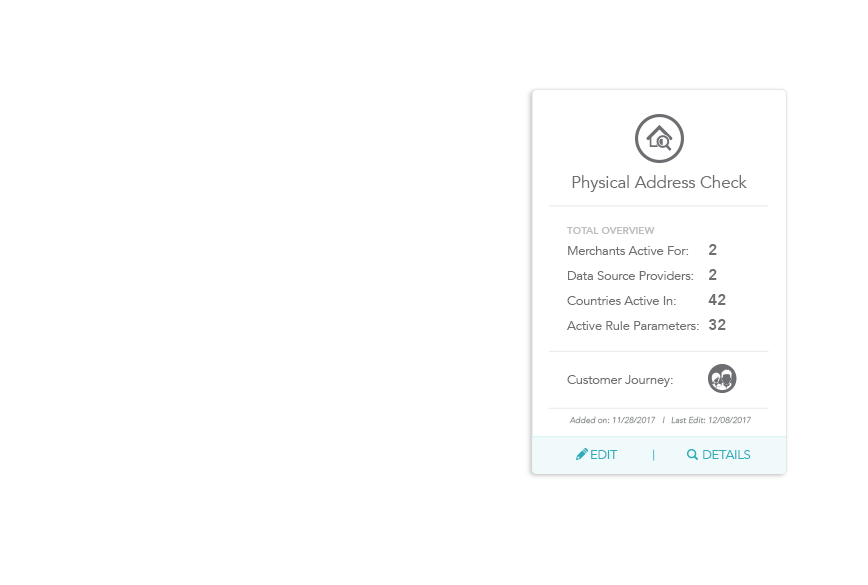

Physical Address

Check (Global)

We quickly and accurately determine your customers address. Validating them at the median level postal address validation to the point of entry.

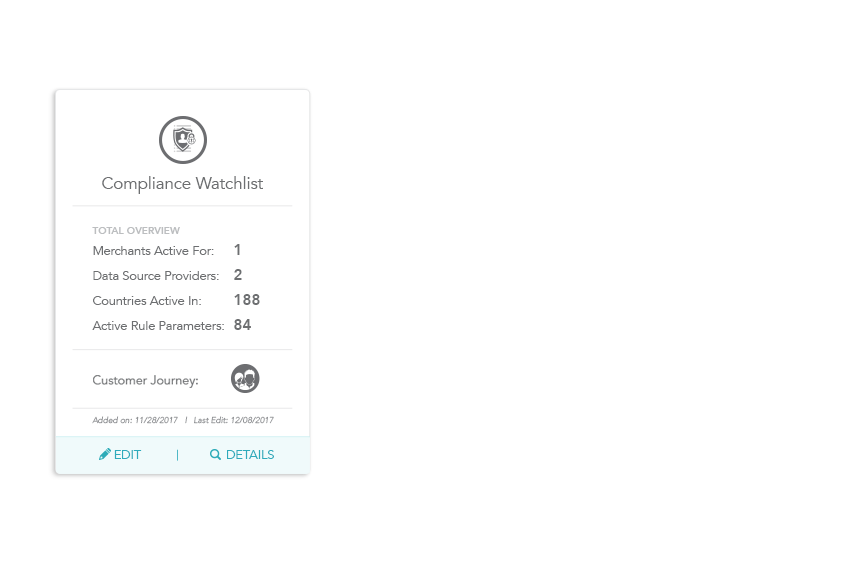

Compliance Watchlist

(Global)

Screen your customers on global sanctions databases including the FATF, OFAC, AML/CTF, PEP, RCA and SIP in real-time to reduce your exposure and risk.

Identity Verification

(Global)

Review and validate customers through selfie capture with biometric face match and liveliness check with document compare to easily obtain Strong Customer Authentication.

Doc ID OCR

(Global)

Automatically verify ID documentation for quality and formating, while reviewing documentation for scrapped data. Comes with easy upload facility and file management area.

Doc ID LIVE

(Global)

Review and validate ID documentation in real-time through our interactive tool consisting of a live webID agent to verify customers instantly over live chat with their documents.

Doc ID Manual

(Global)

Through our back-office verify government issued ID documents or utility bills for quality and formating, scrapped data, and reputation. Comes with easy upload facility and file management area.

CPF Check

(Brazil)

Available for transactional validation of your Brazillian customers. Check the CPF database (the national tax registry in Brazil) down to their province level.

ID Verify

(Brazil)

Available for your brazillian customers to verify their CPF ID, address location to name association, date of birth, phone, relatives and their employment record.

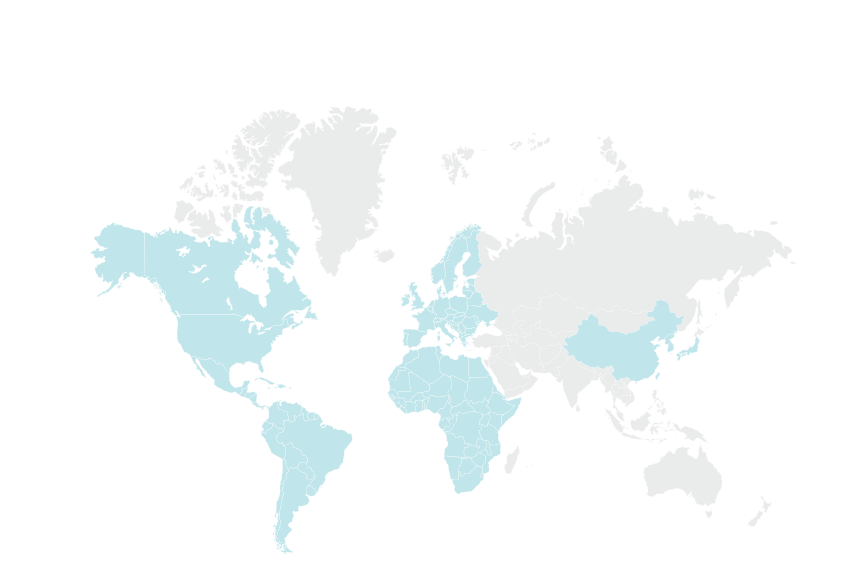

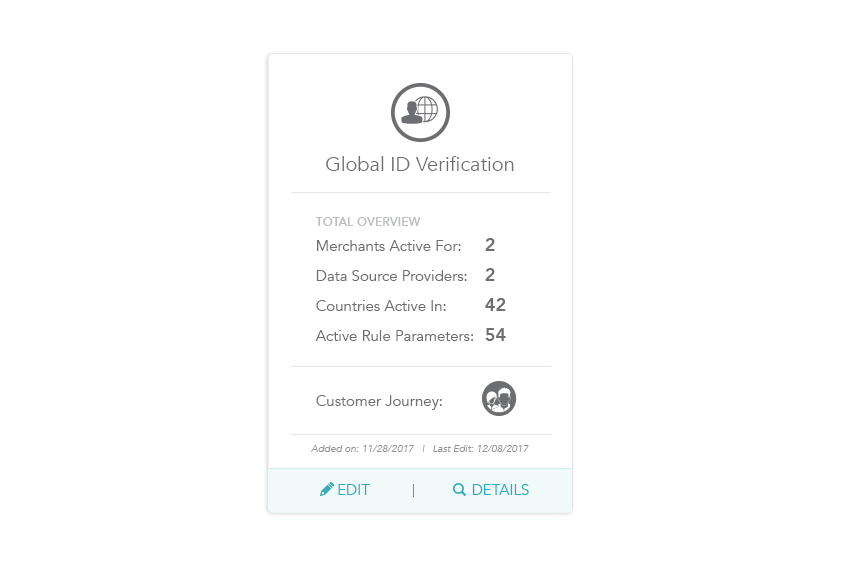

ID Verification Global

Verifying your customers registered first and/or last name to address information, address type and length of residency. In conjunction with their date of birth, phone details and national ID for the following applicable (*) countries.

ARGENTINA *

ARMENIA

AUSTRALIA

AUSTRIA

BELGIUM

BRAZIL *

CANADA

CHINA

CHILE

DENMARK

FINLAND

FRANCE

GERMANY

HONG KONG

IRELAND

ITALY

JAPAN

MALAYSIA

MEXICO *

NETHERLANDS

NEW ZEALAND

NORWAY

PERU

POLAND

PORTUGAL

RUSSIA

SINGAPORE

SOUTH AFRICA

SPAIN *

SWEDEN *

SWITZERLAND

TURKEY *

UNITED KINGDOM

UNITED STATES

VENEZUELA

BVS Verify

(Canada)

Run a soft credit check and profile data match to the Bureau Credit File that includes; name, address, phone, date of birth and optional SIN ID.

ID Verify

(United Kingdom)

Available for all your UK customers to verify their legal first and last name, scanned down to address information including type and location.

ID Verify

(USA)

Available for USA customers to verify their legal first and last name with associated address information on type and location with their date of birth match.

ID Verify Advanced

(USA)

Available for USA customers to verify their legal first and last name with associated address, date of birth match, their SSN, knowledge based answers and reputation.

Phone ID Advanced (USA / Canada)

Instantly retrieve Geo level information with detailed phone characteristics that are scanned down to owners name and address that is associated with the account.

Phone ID Advanced 2

(USA)

Available to USA customers verify phone drilled down to name match on phone account, number validation, phone type, DNC flag and in-service indicator.

Phone 4-Pin

(Global)

Enable voice and SMS two-factor authentication to ensure you have a high degree of security on your transactions, resulting in a reduction in chargebacks.

Knowledge Based

Answers (KBA) (USA)

Give customers personal protection, through setting a series of multiple choice questions they have the answers for, layered with historical profiles.

Bank Account Check

(USA)

Available for USA customers and their transactions and provides detailed ACH intel, bank information and a bank account status check to bring transactional confidence.

Bin Check

(Global)

We will validate the initial six digits of the credit, debit or a prepaid card of your customers, drilled down to bank name, bank country, card level and card type.

Business Verification Services

KYB: Web Monitoring

(Global)

Receive thorough assessment on merchants' online presence with risk indicators flagged, score ratings and recommendations to ensure optimal review process.

KYB: Credit

(United Kingdom)

Receive comprehensive credit reports on businesses within the United Kingdom. Reports encompass a clear understanding of a merchants credit score and credit limit.

KYB: Credit

(Global)

Receive comprehensive credit reports on businesses around the world. Reports encompass a clear understanding of a merchants credit score and credit limit.

KYB: Business Compliance (Global)

Receive all required business documentation including annual accounts, registered checks and reports, articles of association, and shareholder information.

Follow us

Follow us